巴菲特致股东的信(1993年)

④透视收益

透视收益

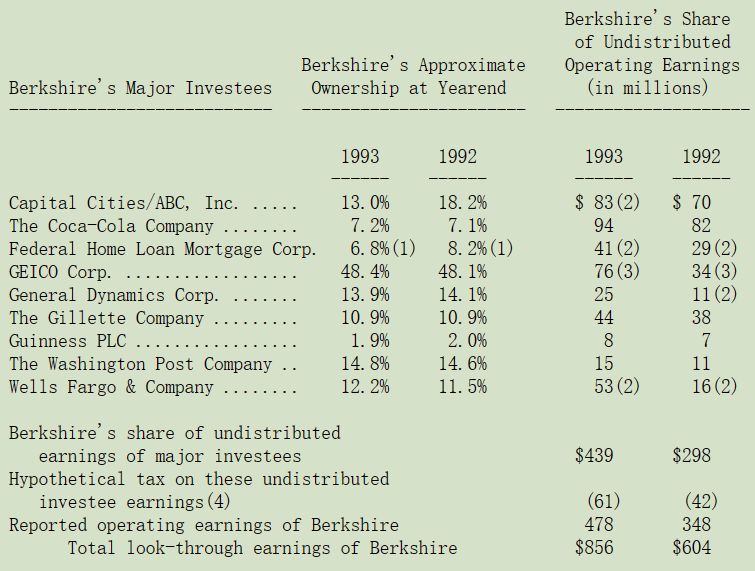

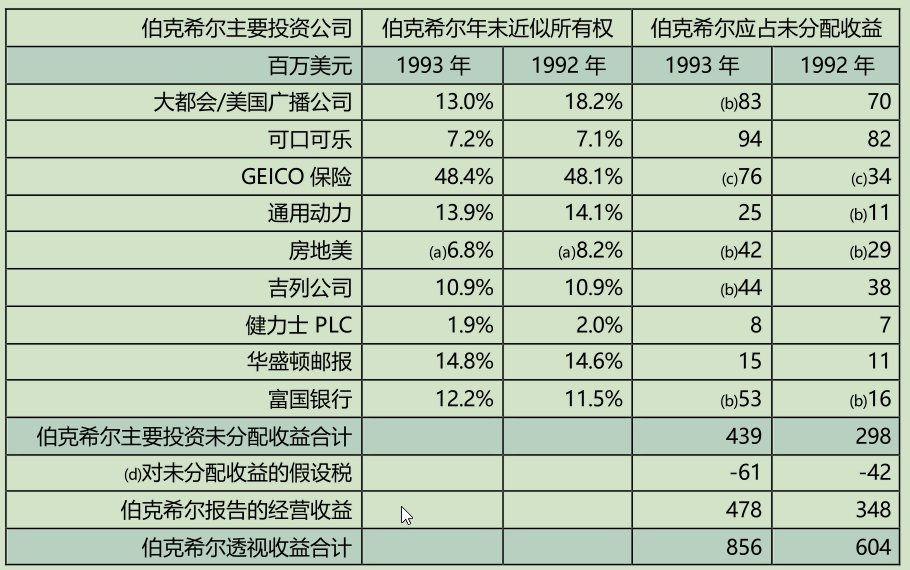

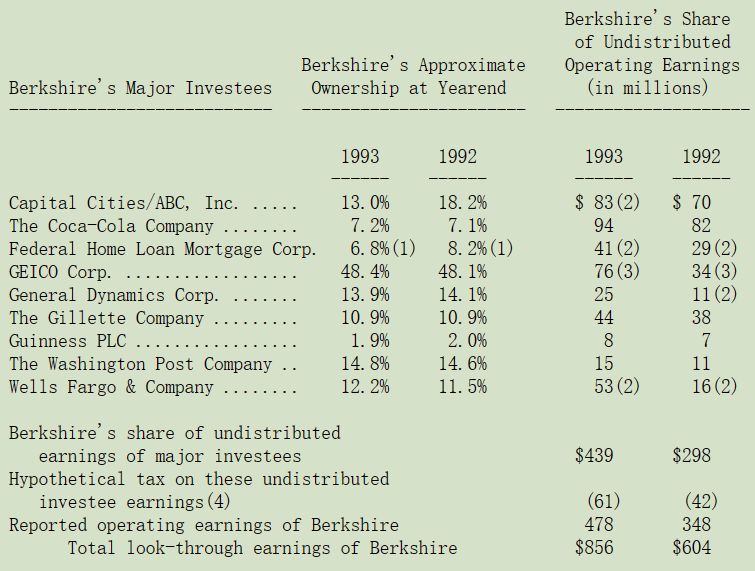

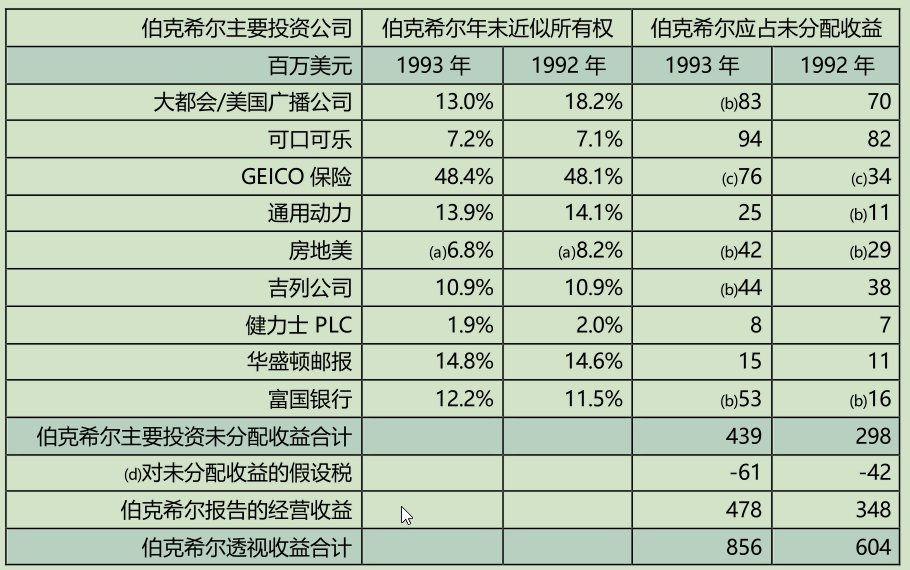

之前我们曾经讨论过透视收益,其主要的组成份子有(1)前段所提到的报告收益,加上(2)主要被投资公司的保留收益,按一般公认会计原则未反应在我们公司报告上的收益,扣除(3)若这些未反应的收益分配给我们时,估计可能要缴的所得税。在这里我们所谓的经营收益系扣除资本利得、特别会计调整与重大重组费用等支出。

长期而言,如果我们的内在价值想要以每年 15%的幅度来成长的话,那么透视收益每年也必须以这个幅度来成长,去年我曾经提到,伯克希尔若要达到 15%的成长目标,2000 年的透视收益必须达到 18 亿美元,而由于1993 年我们又发行了一些新股,所以现在提高到 18.5 亿美元。

这是一个高难度的目标,不过也希望大家能够继续支持我们。在过去,我们批评有些管理层,总是先把箭射出去后再画上靶心,根本不管这箭射得有多歪,因此,我们宁愿冒着尴尬的风险,也要先定好目标再射箭。

如果我们想要命中靶心,那么我们绝对需要有能以合理价格买到好公司或股票的市场,不过现在的市场情况并不理想,当然这种情况随时都有可能会改变,在此同时,我们也会尽量避免,因手上闲钱太多而去做蠢事的冲动,若方向不对,再怎么努力冲刺也是白费力气。

各位可以从下表看出我们是如何计算透视收益的,不过我还是要提醒各位这些数字有点粗糙,(被投资公司所分配的股利收入已经包含在保险业务的净投资收益项下)。

(a)已扣除 wesco 的少数股权;

(b)以年平均持有股权比例计算;

(c)扣除重复发生且金额大的已实现资本利得;

(d)按 14%股息税率计算,这是伯克希尔为其收到的股息支付的税率

我曾告诉过各位,我们期望被投资公司产生的未分配收益(已按估计税率调整)至少可以为伯克希尔创造出同等的内在价值,而到目前为止,其真正的结果甚至远超我们的预期。举例来说,我们在 1986 年以每股 172.5 美元的价格买进 300 万股大都会/ABC 公司的股份,去年我们以每股 630 美元的价格处分了其中的三分之一(回购 100万股),在支付 35%的资本利得税后,我们实现 2.97 亿美元的税后利润。相比之下,在我们持有这些股份的八年期间,大都会公司分配给这些股份的透视收益只有 1.52 亿美元(假设税率为较低的 14%),换句话说,即便在扣除较高的所得税负之后,出售这些股份所获取的利润,远超过这些股份所对应的未分配利润。

我们预计这样的情况在未来还会持续发生,因此,我们相信伯克希尔所计算的透视收益,算是相当保守的表达方式。

〔译文源于芒格书院整理的巴菲特致股东的信〕