巴菲特致股东的信(1994年)

⑧普通股投资

普通股投资

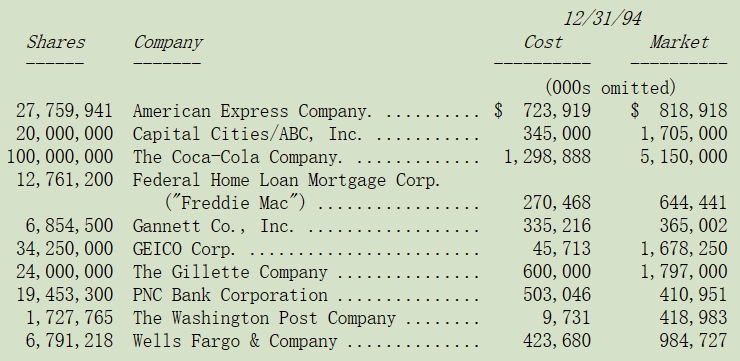

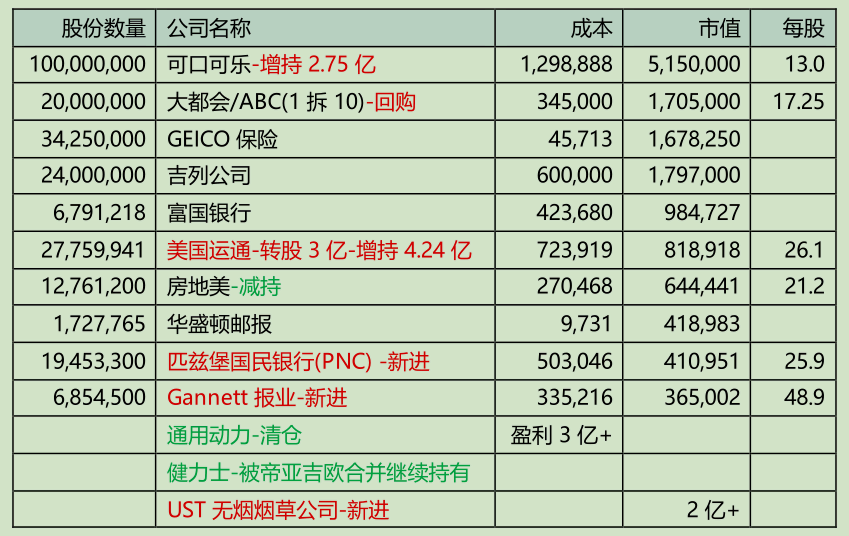

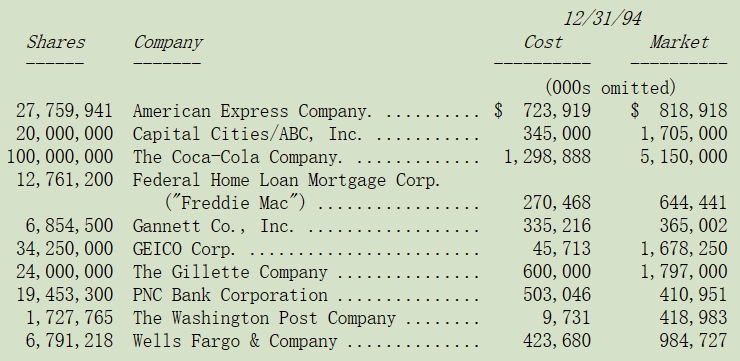

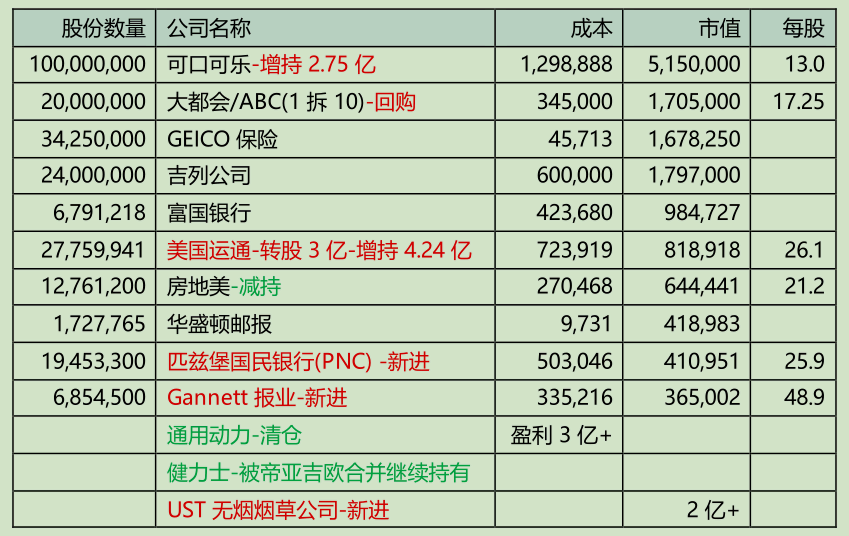

下表是我们超过 3 亿美元以上的普通股投资,一小部分的投资属于伯克希尔非完全控股企业所持有。

我们的投资数量仍然很集中,理念也很简单:真正大的投资理念通常可以用一小段话来解释。我们偏爱具有持久竞争优势并且由德才兼备、以股东利益为导向的经理人所经营的优质企业,只要它们确实拥有这些特质,而且我们能够以合理的价格买进就很难出错,这正是我们一直不断要克服的挑战。

投资人必须谨记,你的投资成绩并非像奥运跳水比赛的方式评分,难度高低并不重要。如果你一家企业的价值在很大程度上取决于一个既易于理解且经久不衰的单一关键因素的判断是正确的,那么回报跟正确分析了一项以许多不断变化和复杂的变量为特征的投资结果是一样的。

对于买进股份我们只关注价格而不择时。我们认为,因为对经济或股市的短期担忧而放弃买进一家长期前景可合理的预期的好公司是一件很愚蠢的事,为什么会因为短期不可知的猜测就放弃一个明智的投资决策呢?

我们分别在 1967 年买进国民保险公司(保险业周期低谷)、1972 年买下喜诗糖果(接班人无心经营)、1977 年买下布法罗新闻报(恶性竞争)、1983 年买下内布拉斯加家具商场(避免后代争夺)、1986 年买下斯科特费泽(杠杆并购),而我们都是趁它们难得出售时才得以买进,当然也因为它们的开价可以接受。当初在评估每个决定时,我们都在思考企业未来可能会做什么,而不是道琼斯指数、美联储或经济未来可能会做什么。如果我们觉得这样的方式适用于买下整家公司的话,那么每当我们决定要通过股市买进一些优质公司一部分股权时,为什么要改变策略呢?

在寻找新的投资标的之前,我们会优先考虑增加已有投资的仓位,如果一家企业曾经好到让我们愿意买进,那么重复这一过程可能会很划算。若是有可能我们很愿意再增加在喜诗糖果或是斯科特费泽的持股,但 100%持有想要再增加已经不可能了。然而在股票市场中,投资人常常有很多的机会可以增加他了解并喜欢的公司持股。去年我们就增持了我们在可口可乐(2.75 亿)与美国运通(4.24 亿)的仓位。

我们投资美国运通的历史(色拉油丑闻)可以追溯到 1965 年,而事实上这也符合从个人过去的公司名单中挖掘投资决策的模式。例如在 1951 年,当时我还是年仅 20 岁的股票业务员,350 股 GEICO 保险占我个人投资组合的 70%,同时它也是我第一次卖掉的股票,我将其中的 100 股卖给我的姑妈 Alice,基本上只要是我建议的她都照单全收。25 年后趁着 GEICO 面临倒闭的危机(为了成长不计成本扩张),伯克希尔买下其一大部分的股份。另一个例子就是华盛顿邮报(水门事件),1940 年代,我的初始投资资金有一半是来自派送该报纸的收入,三十年后,伯克希尔趁该公司上市两年后遭遇的危机(报道水门事件被政治打压以及工会罢工)引发的股价低档买下一大部分的股权。至于可口可乐(盲目多元化),可以算得上是我生平从事的第一笔商业交易,1930 年代当我还是个小孩子的时候,我花了 25 美元买了半打的可乐,然后再以每罐 5 美分分售出去,而直到 50 年后,我才终于搞懂真正有赚头的还是那糖水。

我个人在美国运通的投资历史包含好几段插曲,在 1960 年代中期,趁着该公司为色拉油丑闻遭受重创时,我们将巴菲特合伙企业 40%的资金压在这只股票上,这是合伙企业有史以来最大的一笔投资,总计花了 1,300 万美元买进该公司 5%的股份。时至今日,我们在美国运通的持股将近 10%,但帐列成本却高达 13.6 亿美元,(美国运通 1964 年的盈利为 1,250 万美元,1994 年则增加至 14 亿美元)

我对美国运通 IDS 金融部门的投资可以追溯更早,该部门目前占公司整体收益来源的三分之一,我在 1953年第一次买进成长快速的 IDS 股份,当时的只有三倍市盈率(在那个年代低垂的果子垂手可得),为此我甚至还特别写了一篇长篇报告(不过印象中我好象没有写过短的),并在华尔街日报刊登广告,报价 1 美元公开求购。

显然,美国运通与 IDS(最近已更名为美国运通财务顾问)今日的营运与过去已有很大的不同,然而,我发现长期熟悉一家公司及其产品通常有助于对其进行评估。

〔译文源于芒格书院整理的巴菲特致股东的信〕