巴菲特致股东的信(1994年)

⑦保险业务

保险业务

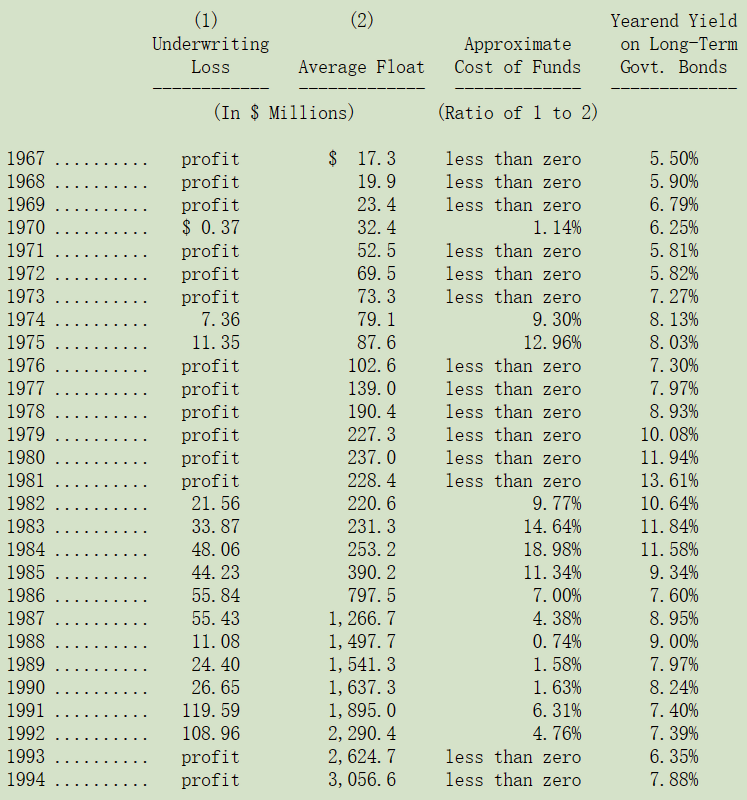

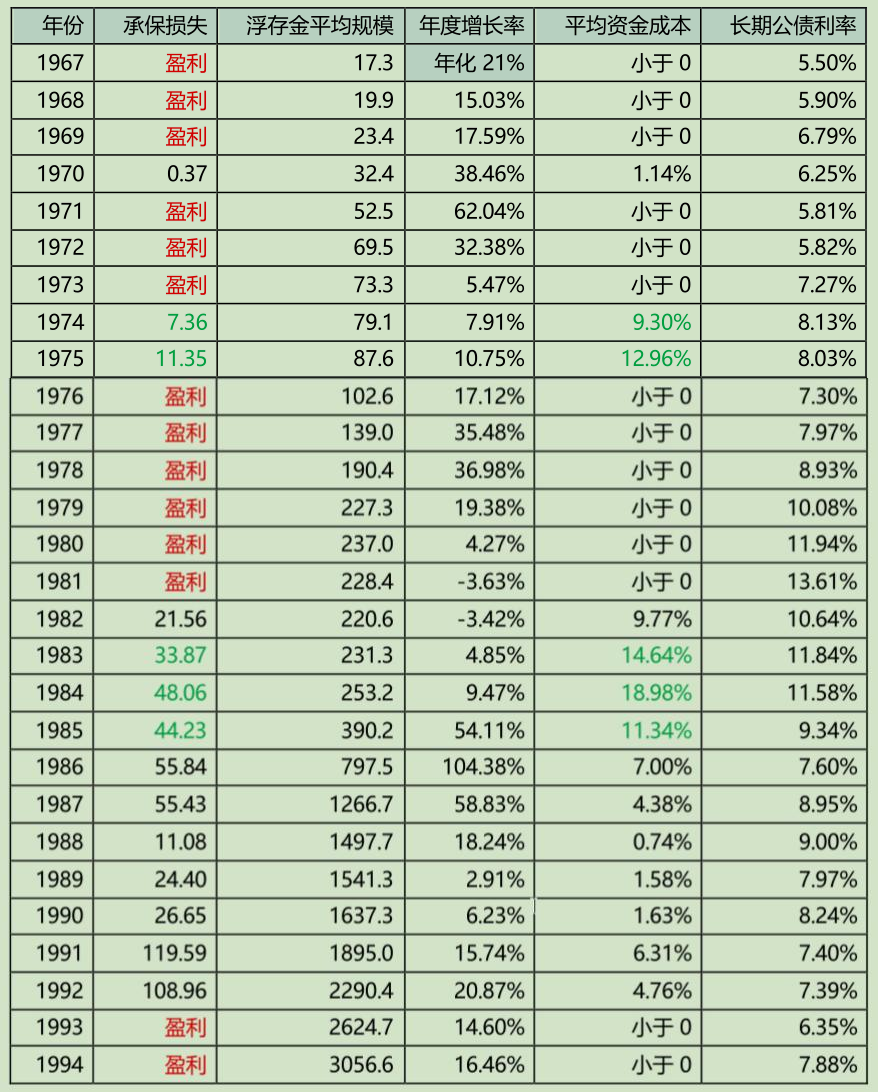

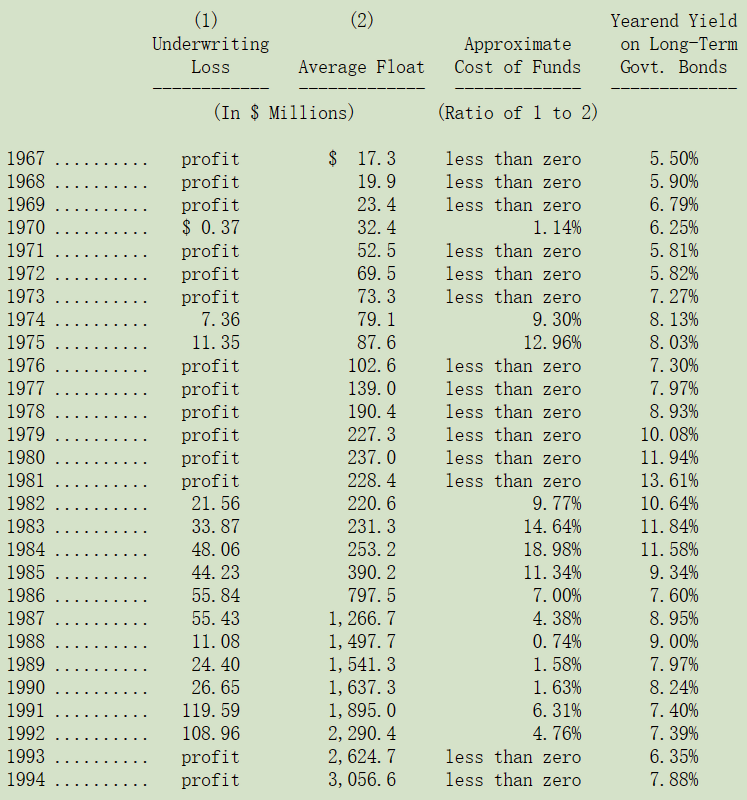

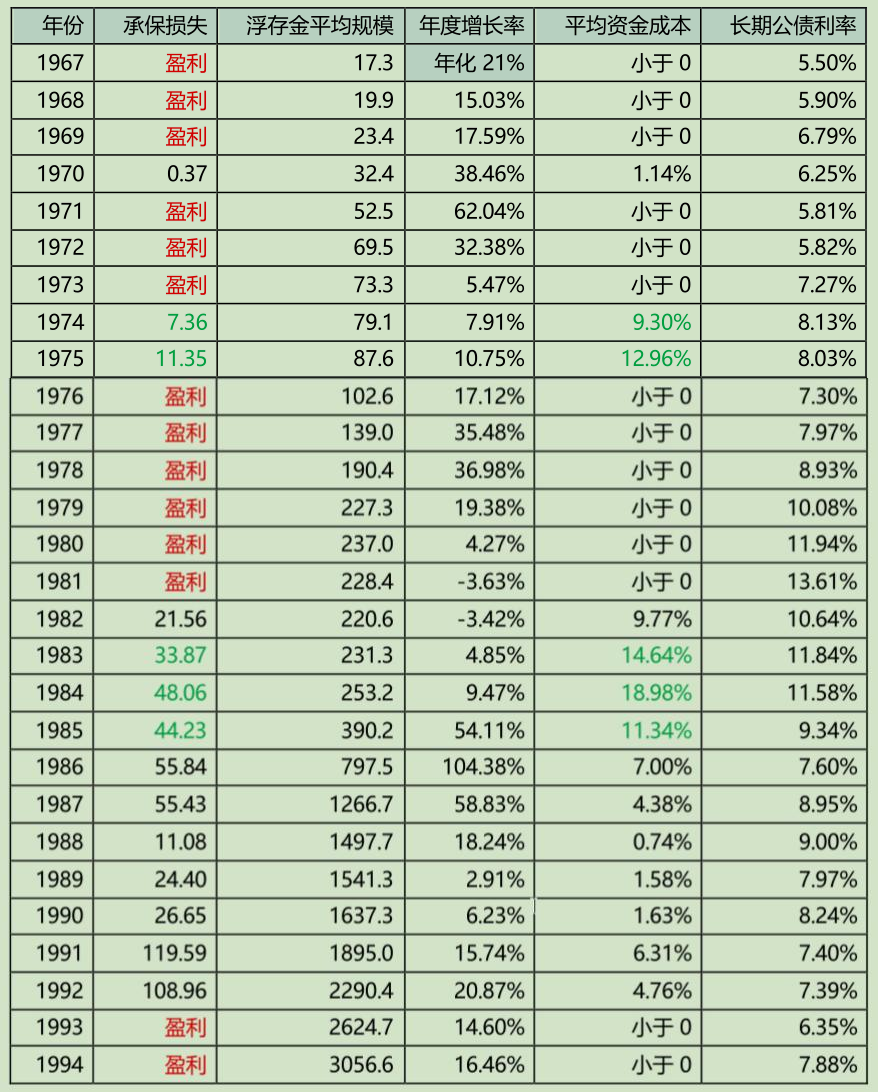

正如我们在过去年报跟各位解释过的,我们保险业务最重要的是,第一是浮存金的新增规模,第二是浮存金的获取成本。浮存金是我们持有但不拥有的钱,保险业务营运中存在浮存金是因为,大部分的保单都要求保户预付保费,更重要的是保险公司真正理赔之前,通常都要需要时间审核并处理索赔。

通常保险公司实际上收到的保费并不足以覆盖发生的索赔损失与运营费用,这就导致承保损失,而这就是浮存金的成本。

长期而言,保险公司的浮存金成本若能低于其它资金获取渠道所需的成本,则随着时间的推移,保险业务就是有利可图的。相反,若浮存金成本长期高于货币市场利率的话,保险业务就没有什么价值。

如同下表中的数字所显示的,伯克希尔的保险业务大获全胜。对于该表,浮存金是将损失准备金、损失调整准备金,再保险假设准备金和未到期责任准备金加总后,再减去应付再保险代理成本、预付购置成本,预付税款及递延费用。相对于我们的保费数量而言,我们产生了非常多的浮存金,而浮存金的成本则取决于承保的损失或利润。比如过去两年我们取得了承保盈利,我们的浮动成本就是负值。我们通过将承保利润与浮存金投资收益相加来确定我们的保险业务收益。

查理跟我对于 1994 年的浮存金能够继续成长都感到相当高兴,更高兴的是这些资金是完全免费的,但是我们还是要像去年那样再强调一次,尽管我们的保险业还不错,但实际远不如目前看起来的那么好。

我们之所以一再强调这一点,原因在于我们的巨灾再保险业务(超级猫是专门提供保险公司与再保公司规避重大自然灾害风险的保单)今年再度赚大钱,由于真正重大的灾害并不常发生,所以我们的巨灾险业务有可能在连续几年赚大钱后,突然发生重大的损失,换句话说,我们这项巨灾险业务可能要花上好几年才有办法看得清楚,当然 1994 年绝对是相当好的一年,唯一的重大灾害要算一月所发生的加州大地震,另外在这里我要特别声明 1995年初发生的神户大地震对我们造成的损失并不大。

巨灾险保单有数量少、金额高且非标准化的特性,因此,要承接这类业务必须依赖相当专业的判断能力,而不像一般的汽车保险有庞大的数据库可供参考,就这点而言,伯克希尔拥有一张王牌阿吉特·贾恩(Ajit Jain),他是我们巨灾险业务的经理人,拥有最好的承保技巧,他可以说是我们的无价之宝。

此外在巨灾险业务,伯克希尔还拥有一项特殊的优势,那就是我们雄厚的财务实力,这对我们有相当大的帮助。首先,一家谨慎小心的保险公司都会希望自己能够防范真正的特大灾害,比如造成 500 亿美元损失的纽约长岛飓风或加州大地震。但是保险公司也相当清楚,这类依赖大型保险赔付的灾难同样也会导致许多再保公司自顾不暇而破产,所以它们不太可能笨到向无法兑现的承诺支付再保费。因此,伯克希尔可以确保在不可预期的天灾发生时,既有偿付能力又有流动性,就是我们最佳的竞争优势。

我们资本实力的第二个好处是,我们可以签下别人想都不敢想的巨额保单。举例来说,1994 年,有一家保险业者临时想要买一张保额高达 4 亿美元的加州地震险保单,我们二话不说立刻接下来,我们敢说全世界除了我们以外,可能没有人敢独立接下这样的保单。

一般来说,保险经纪人通常倾向将大额的保单拆成数张小额的保单以分散承保,但是这类保单会耗费大量时间。与此同时,希望再保险分散风险的公司将承担其不希望承担的风险,进而危及保险公司本身的利益。相对地在伯克希尔,我们对单一保单的投保上限最高可以到达 5 亿美元,这是其它同业所做不到的。

虽然接下这类大额的保单,会使得伯克希尔的经营成果变得很不稳定,但我们完全可以接受这样的结果,通常保险同业(其实其它的行业也一样)为了平滑业绩总是倾向采取比较保守的次优策略。我们选择接受变动较大的前景,以期获取比前景确定的方式更高的长期投资回报。

考虑到我们承受的风险,阿吉特跟我总是会将关注点放在最坏的状况下,虽然我们知道实在是很难去衡量,大家可以想象如果长岛飓风、加州地震以及损失更大的自然灾害发生在同一年时会是怎样的一个光景。此外,保险损失也可能会伴随非保险的问题,例如假设我们因为加州大地震而承受大量的巨灾险损失,而此时股市很可能也会大跌,此举将会使得我们在喜诗糖果、富国银行与房利美的持股价值大减。

在考虑过所有的状况之后,我们认为在最坏的情况下承保巨灾险最高损失大约在税后 6 亿美元左右,稍稍超过伯克希尔其它事业的收益,如果你对于这样的风险感到不舒服,那么现在是你卖出伯克希尔股份的最佳时机,而不是等到这种无可避免的大灾难发生。

我们巨灾险的业务量在 1995 年很有可能会下滑,因为保单价格正在下滑。由于几年前新进入再保市场的资本正以不合理的价格竞逐保单,尽管如此,我们还是拥有一些重要的客户群,可以稳定的贡献我们 1995 年业绩。

伯克希尔其它保险业务 1994 年的营运表现皆相当杰出,由 Rod Eldred 领导的住宅保险业务(Home-State)、Brad Kinstler 带领的工伤赔偿保险业务、Kizer 家族经营的信用卡违约险业务,以及由 Don Wurster 所领导的国民保险所从事的商用汽车与一般责任险业务,总的来说,这四类业务都表现的相当不错,不但有承保利润,还贡献了相当大金额的保险浮存金。

总而言之,我们可以做出与去年同样的结论,我们拥有第一流的保险业务,虽然他们的经营成果波动相当的大,但是其内在价值却远远超过其帐面价值,而事实上,比伯克希尔其它业务都大。

〔译文源于芒格书院整理的巴菲特致股东的信〕