巴菲特致合伙人的信(1964年)

④复利的喜悦

复利的喜悦

有的合伙人读了前几年的信,反馈说怎么讲的都是现当代的投资案例,能不能提高点难度,深入讲讲跨越几个世纪的投资策略。于是,我就写了这部分。

在之前的两则投资错误剖析中,我们讲了伊莎贝拉女王(赞助哥伦布远洋航行)和弗朗西斯一世(购买名画《蒙娜丽莎》)所谓精明的投资,实际上是蠢到家了。有些人为这两位的错误辩解,说来说去都是感情用事。在我们的复利表面前,一切辩解都苍白无力。

有一个质疑还有些合理。有人说,在我写的这部分内容里,用的案例都是负面的,只是在批评历史上投资能力低下的人。有没有投资能力高超的案例,有没有人的光辉业绩世代流传,值得后来者学习?

当然有。传说中的曼哈顿印第安人就因为他们精明的商业头脑而名垂青史。1626 年, 他们把曼哈顿岛卖给了有名的败家子彼得·米努伊特(Peter Minuit)。据我所知,印第安人最后拿到手是 24 美元。米努伊特获得了 57.8 平方公里的土地,相当于 57,756,735 平方米。 目前,曼哈顿岛的价值是 12,433,766,400 美元(124 亿),约合每平米 215 美元。外行乍一看,觉得米努伊特赚了。其实,印第安人只要实现每年 6.5%的收益率(部落基金的销售 代表应该敢承诺这个收益率),他们就能笑到最后。按照每年 6.5%的收益率,经过 338 年,24 美元会变成 42,105,772,800 美元(420 亿)。如果他们的收益率能再高 0.5 个百分点, 达到 7%,他们的钱现在就是 2050 亿美元。讲完了。

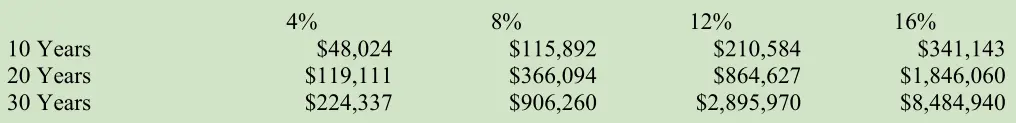

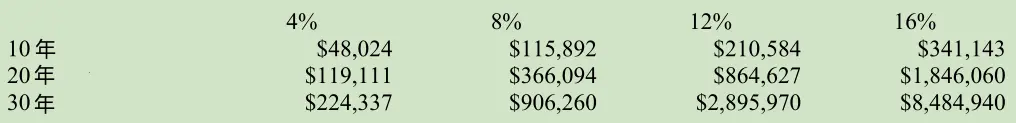

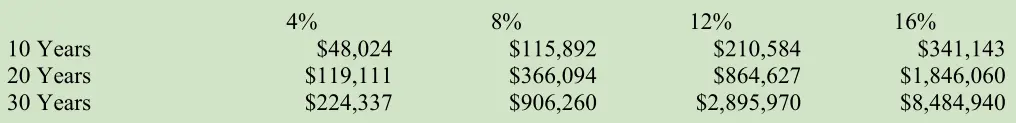

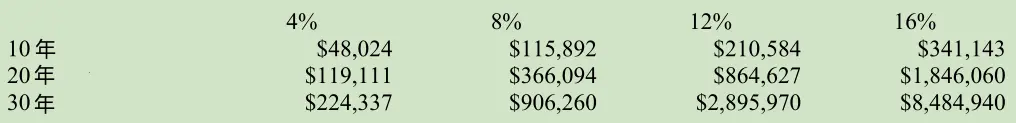

有的合伙人考虑投资策略时可能不会想这么长远。还是像往常一样,下面是 100,000 美元按照不同收益率复利累积的结果,方便各位参考。

从这个表格中可以看出,下列三个因素对资金增长有好处:

(1)寿命长(在金融大牛的行话里,这个叫“玛士撒拉效应”(Methuselah Technique))

(2)复合增长率高

(3)上述两者兼而有之(笔者特别推荐)

如上表所示,复合增长率稍微高一点,最后的收益就会高很多。正因为如此,尽管我们希望自己的业绩能远远高于平均水平,但是对我们来说,高于平均水平的每一个百分点都有实际意义。

〔译文来源于梁孝永康所编全集〕