巴菲特致合伙人的信(1966年)

③1966年业绩分析

1966年业绩分析

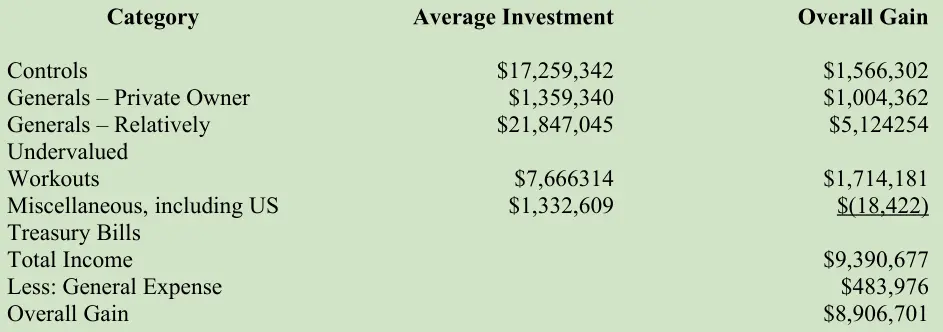

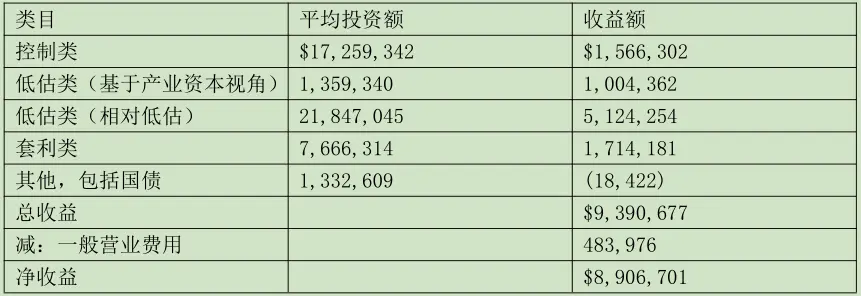

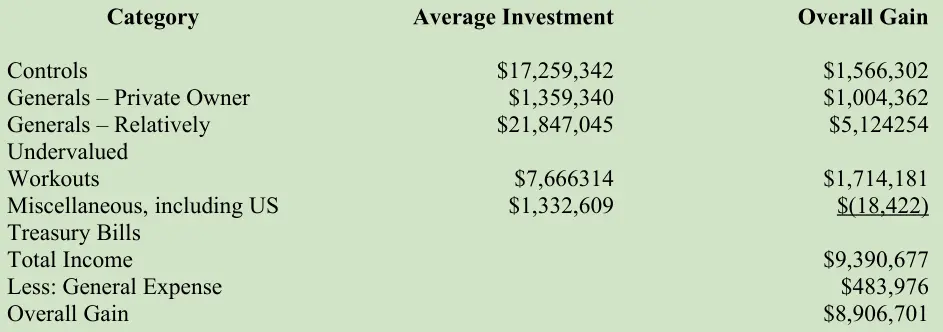

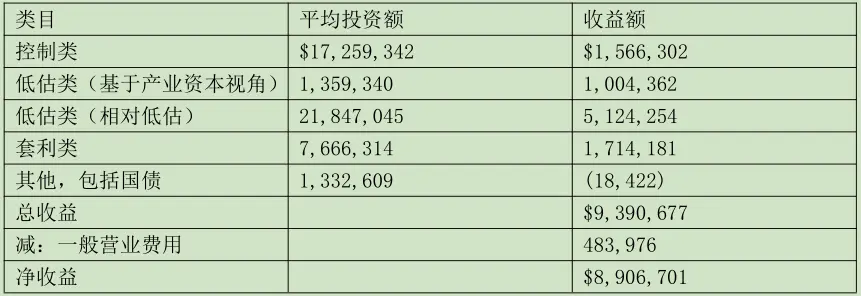

1966年我们的四大类投资都表现不错。我们实现的总收益是8,906,701美元,具体如下:

开始讨论之前,有几个地方需要说明一下:

1.1965年1月18日的信中介绍了上述各个投资类别。如果你需要回顾一下,在附近的报刊亭又买不到便携版,欢迎向我们索取。

2.分类不是严丝合缝的。一笔投资归在哪个类别,事后不会更改,但最初归类时多少有些主观因素。

3.计算合伙基金收益率时,我们以年初投资金额为基准。上述表格记录的是各类投资的平均投资金额,这样计算出来的收益率比实际低。例如,一只股票,我们1月1日以100美元买入,到12月31日,它上涨到150美元,则平均投资金额是125美元,收益率是40%,而按照常用的计算方法,收益率则是50%。换言之,上表中的平均投资金额是以每月的平均市值计算的。

4.所有数字均按照100%自有资金、无杠杆的基础计算。利息和日常费用从总收益中扣除,不分摊到各个类别。与具体某笔投资直接相关的费用,例如,因做空股票而支付的股息,直接从相应类别中扣除。在涉及融券做空的情况下,计算平均投资金额时,用多头仓位减去空头仓位得出净投资金额。

5.上述表格用处有限。各个投资类别的收益都主要是一两笔投资贡献的。如果你收集了大量稳定的数据(例如,美国男性的死亡率),就可以从中得出一些结论和预测,但我们的投资不是这么回事。我们在投资中面临的是一系列不知何时出现、各有不同特点的事件,我们要前思后想,琢磨各种可能性,然后做出决定。

6.最后,我们在进行上述计算时不像数钱时那么上心,再说这也算不上纯粹的自检,所以里面可能有笔误或计算错误。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕