巴菲特致股东的信(1979年)

③盈余报告④纺织业及零售业

盈余报告

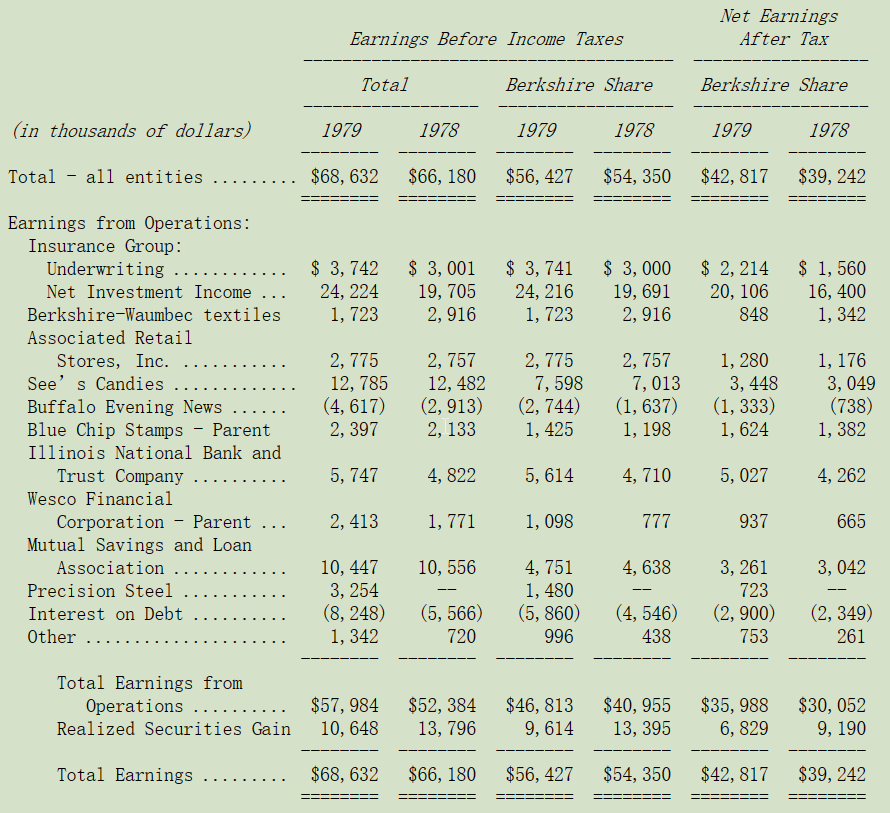

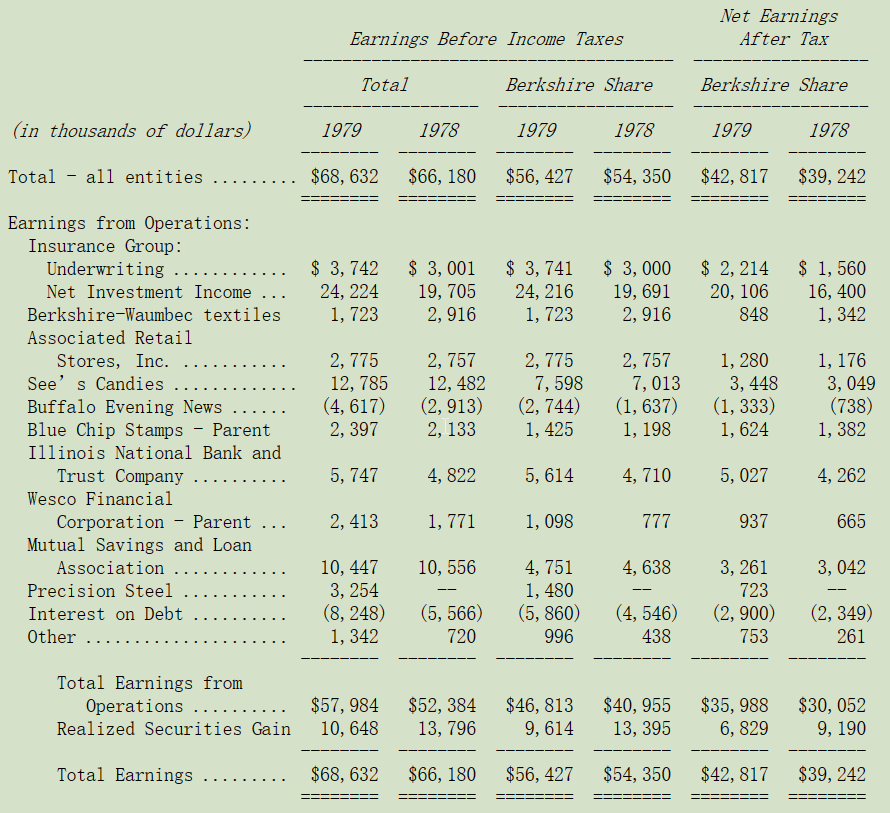

下表系伯克希尔盈余的报告,去年我们曾向各位说明过,伯克希尔持有蓝筹印花60%的股权,后者又持有80%的Wesco金融公司,表中显示各个事业体的盈余合计数,以及伯克希尔依持股比例可分得的部份,各事业体的资本利得或损失则不包含在营业利益项下,而是加总列在已实现资本利得项下。

蓝筹印花及Wesco都是公开发行公司,各自都必须对外公开报告,在年报的后段附有这两家公司主要经理人关于公司1979年现况的书面报告,他们运用的部份数字可能无法与我们所报告的丝毫不差,但这又是因为会计与税务一些细节规定所致,(Yanomamo印地安人只会用三个数字:一、二、大于二),不过我认为他们的见解将有助于各位了解这些旗下重要事业的经营现况,以及未来发展的前景。

若有需要伯克希尔的股东可向Mr.Robert(地址:加州洛杉矶5801 South Eastern Avenue)索取蓝筹印花的年报或向Mrs.Bette(地址:加州Pasadena 315 East Colorado Boulevard)索取Wesco的年报。

纺织业及零售业

随着保险事业规模与盈余快速的成长,纺织业与零售业占整体事业的重要性日益下滑,然而尽管如此,联合零售商店的Ben Rosner还是不断地化腐朽为神奇,即使产业面临停滞不前的窘境,却能利用有限的资本创造出可观的盈余,且大多是现金而非尽是增加一些应收款或存货。Ben现年76岁,就像是其它后进者,伊利诺国家银行82岁的Gene Abegg、Wesco74岁的Louis Vincenti一样,其功力日益深厚。

虽然我们的纺织事业仍持续不断地有现金流入,但与过去所投入的资金实在是不成正比,这并非经理人的过错,主要是产业的环境使然,在某些产业,比如说地方电视台,只要少数的有形资产就能赚取大量的盈余,而这行的资产售价也奇高,帐面一块钱的东西可以喊价到十块钱,这反应出其惊人获利能力的身价,虽然价格有点吓人,但那样的产业路子可能反而比较好走。

当然我们也不是没有试过其它方法,在纺织业就曾经过数度挣扎,各位的董事长也就是本人,在数年前曾买下位于Manchester的Waumbec纺织厂,以扩大我们在纺织业的投资,虽然买进的价格相当划算,也取得一些价美物廉的机器设备与不动产,几乎可以说是半买半送的,但即使我们再怎么努力,整个决策事后证明依然是个错误。因为就算我们再努力,旧的问题好不容易才解决,新的状况又冒出来。

最后在经过多次惨痛的教训之后,我们得到的结论是,所谓有“转机”的公司,最后显少有成功的案例,所以与其把时间与精力花在购买廉价的烂公司上,还不如以合理的价格投资一些体质好的企业。Waumbec虽然是个错误,但所幸并未酿成灾难,部份的产业仍对位于NewBedford的室内装饰品生产线(这是我们最强的业务)有所助益,而我们也相信Manchester在大幅缩减营运规模之后,仍将有获利的空间,只是我们原先的理论被证明不可行。

〔译文来源于梁孝永康所编《巴菲特致合伙人+致股东的信全集》〕