巴菲特致股东的信(1982年)

③报告收益来源

报告收益来源

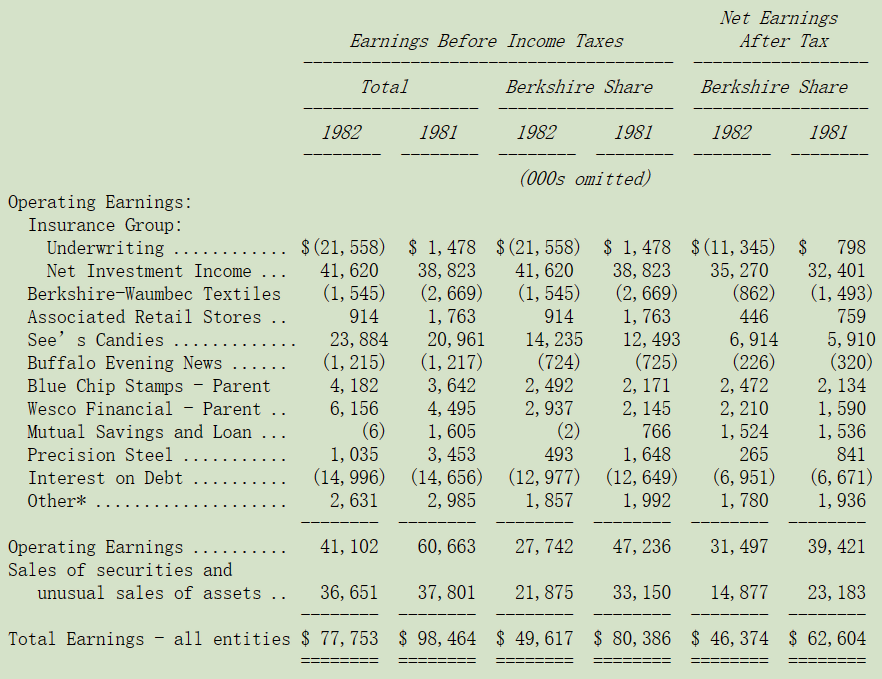

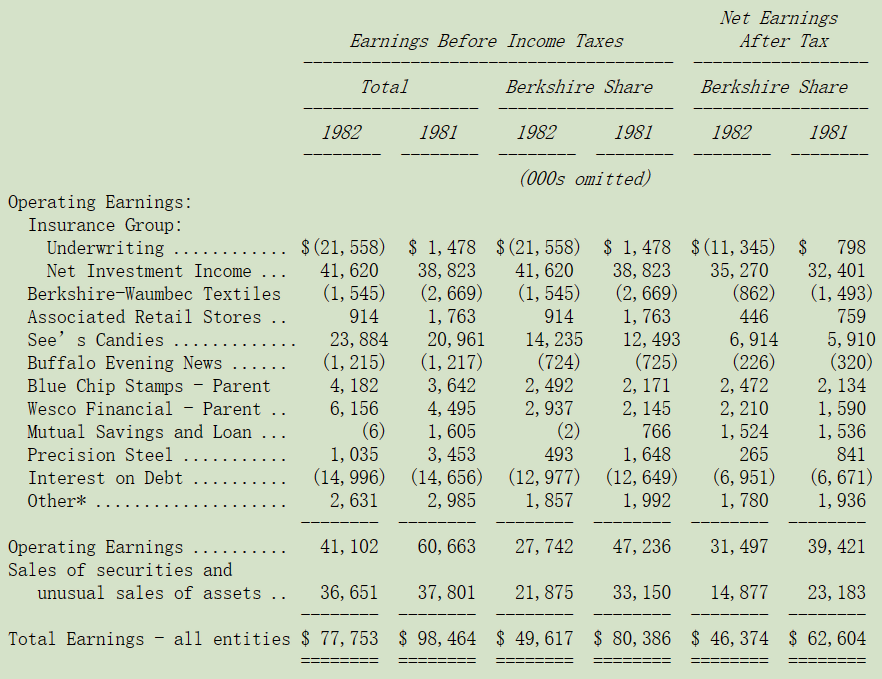

下表显示伯克希尔依照各个公司持股比例来列示帐面盈余的主要来源,而各个公司资本利得损失并不包含在内而是汇总于下表最后“已实现出售证券利得”一栏,虽然本表列示的方式与一般公认会计原则不尽相同但最后的损益数字却是一致的。其中伯克希尔拥有蓝筹印花60%的股权,而后者又拥有Wesco财务公司80%的股权。

*包含购并企业商誉的摊销(如喜诗糖果;Mutual;水牛城晚报等)

本报告附有蓝筹印花及Wesco两家公司主要经营阶层对其1982年公司经营作的一番叙述,其中我相信你会发现有关蓝筹印花在水牛城晚报的情况特别有意思,目前全美大约有十四个城市的日报业者其每周发行量超过水牛城,但真正的关键却在于星期天发行量的成长,六年前也就是在周日版尚未推出之前,原本在水牛城发行星期天报纸的Courier-Express约有27万份的发行量,而如今即使该地区家庭户数未见成长单单水牛城新闻在周日便有36万份,约为35%的成长,就我们所知这是在全美其它地区所未见的,一切都要归功该报的管理阶层为我们所做的努力。

如同我们先前曾说明过的,非控股股权投资未分配的盈余其重要性早以不下于前表所列公司帐面营业净利。当然,非控股股权投资已分配的盈余部分主要通过保险集团收益的净投资收益部分进入该表。

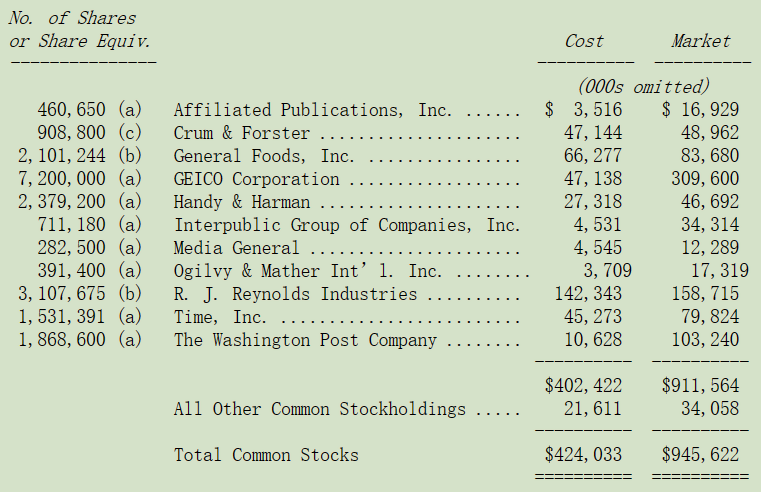

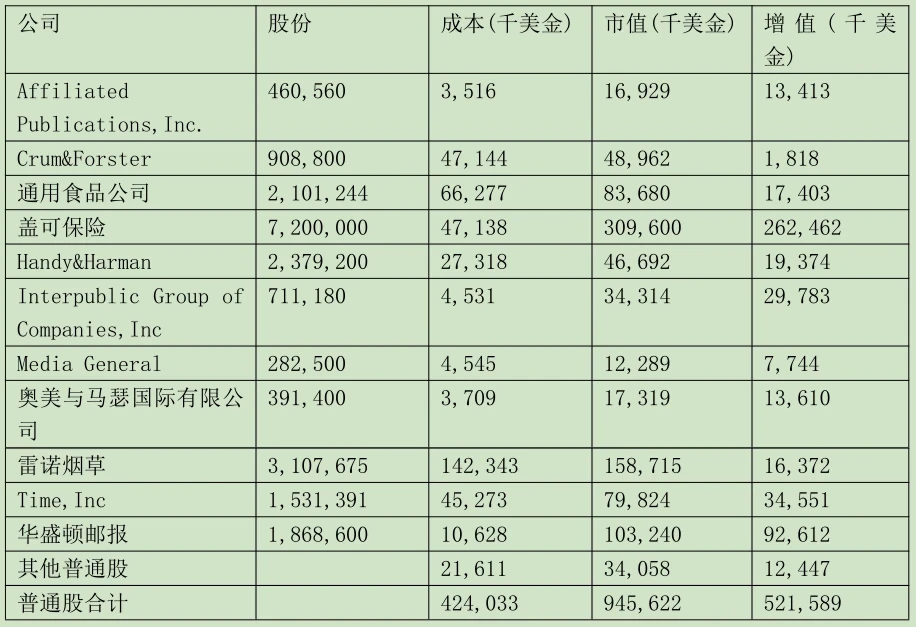

下表所列系我们在不具控制权的股权投资依持股比例所应有之权益:

(a)全部由伯克希尔或其保险子公司拥有。

(b)代表由伯克希尔子公司蓝筹印花与维斯科所持有,所有数字代表依伯克希尔持股比例换算得来的净权益。

(c)临时持有作为现金替代。

为免你未注意到,本表有个投资经验可与大家分享,念旧在我们投资选股时必须特别加以重视,我们投资组合中具有最大未实现利益的两家公司盖可保险与华盛顿邮报,事实上本人早在13岁与20岁时便与它们结缘,但磋跎了二十几年,迟至1970年代我们才正式成为该公司的股东,但结果证明所谓:“迟到总比未到好。”

由于我们具控制权与不具控制权的股权投资经营的行业实在是相当广泛,若我一一详细介绍将会使得报告变得冗长,然而这其中不管是现在或是将来最主要的事业经营将会是摆在产险与意外险领域之上,因此我们有必要对保险产业现状予以详加说明。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕