巴菲特致股东的信(1982年)

④保险业情况

保险业情况

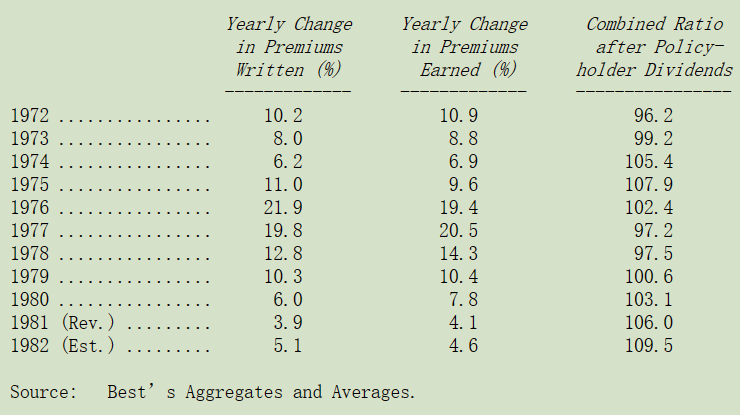

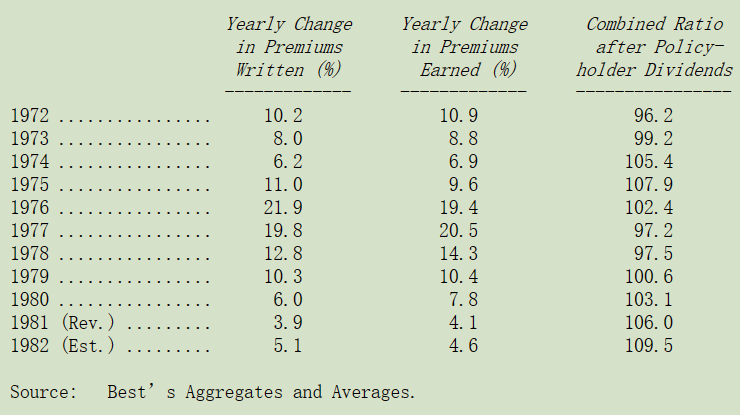

下表显示的是去年我们曾引用过,经过更新后的产业统计数字,其所传达的讯息相当明显,我们将不会对1983年的承保结果感到吃惊。

数据正说明了目前整个所面临到的状况,综合比率系表示经营成本加上理赔损失除以保费收入的比率,若比率小于100%则表示有承保利益,反之则有承保损失。

就如同去年我们所说的一样,若承销保费年增率低于10%,你就会发现隔年的承保结果恶化,即使像通膨率相对较低的今日也是如此,随着保单日益成长,医疗费用上涨的速度远高于一般物价,加上保险责任日益扩大的影响,承保损失将很难压低到10%以下。

大家必须有所认知1982年的综合比率109.5已是相当乐观的估计,在以前年代保险公司几乎可依自身喜好来调整年度获利,只要(1)承销长期保单(Long-tail)因为理赔成本多采用估计;(2)以前年度提存有适当准备;或(3)业务成长快速。有迹象显示有几家大型保险公司倾向以模糊的会计与挪动准备的方式来掩饰其本业不佳的情况。保险业,跟其它行业一样,不良的经营阶层对不良的营运通常最直接的反应就是不良的帐务,俗语说:“你很难让一个空沙包站得直挺挺的”。

当然大部份的经营阶层都尽力按正正当当的游戏规则玩,但即使是正直的管理当局在面对获利不佳的情况时,下意识多多少少也不会愿意完全承认走下坡的窘境,产业统计资料指出在1982年对于提列损失准备方面有恶化迹象,而实际的综合比率可能会比表列数更差一点。

一般认为在1983或1984年会到谷底,然后产业循环会如同过去经验一般缓步稳定地向上,但由于一项明显的改变(这种改变已许多年未见,而如今却重现)使我们抱持不同的看法。

对此我们必须探究几项影响企业获利的重要因素才能了解这种改变,一般来说若企业处在产业面临供给过剩且为产品一般商品化的情形(在整体表现、外观、售后服务等都无差异化)时,便极有可能发生获利警讯,当然若价格或成本在某些情况下(例如透过政府立法干预、非法勾结或国际性联合垄断如OPEC)能获得控制或可稍微免除自由市场竞争。

否则若客户不在乎其所采用的产品或通路服务由谁提供,成本与价格系由完全竞争来决定,如此产业铁定会面临悲惨的下场。

这也是为什么所有的厂商皆努力强调并建立本身产品或服务的差异性,这种作法在糖果有用(消费者会指明品牌)而砂糖却没有用(难道你听过有人会说:“我的咖啡要加奶精和某某牌的砂糖”)。

在许多产业就是无法作到差异化,有些生产者能因具成本优势而表现杰出,然在定义上这种情况极少或甚至不存在,所以对大部份销售已完全商品化的公司来说,不可避免的结局便是,持续的产能过剩无法控制价格滑落导致获利不佳。

当然产能过剩会因产能缩减或需求增加而自我修正,而不幸的是这种修正的过程却是缓慢而痛苦的,当产业好不容易面临反弹时,却又是一窝蜂全面扩张的开始,不到几年又必须面对先前的窘况。

而最后决定产业长期获利情况的是供给吃紧与供给过剩年度的比率,通常这种比率很小,(以我们在纺织业的经验来说,供给吃紧的情况要追溯到许多年以前,且大约仅维持不到一个早上的时间)。

在某一些产业,供给吃紧的情况却可以维持上好一段期间,有时实际需求的成长甚至超过当初所预期,而要增加产能因涉及复杂的规划与建厂而须有相当的前置期。

回归正题谈到保险业,供给量能马上提高只要业者增加点资本(有些时候由于州政府立法保障保户免于保险公司倒闭风险,甚至可不需要增加资本),在绝大数的情况下,(除了发生股市大崩盘或自然界的大天灾)保险业皆处于过度竞争的环境下经营,通常来说尽管勇于尝试多变化,业者所销售的保单多属于无差异化的一般商品(许多保户包含大公司的经理人在内,甚至不知道自己所投保的是那一家保险公司),所以保险业在教科书当中一般被归类为面临供给过剩且产品一般商品化死胡同的艰困行业。

那么为什么保险业即使在面临这种情况下,数十年来仍能有所获利?(在1950年到1970年间产业平均的综合比率为99.0,使得公司获利除投资收益外,还外加1%的承销利益,答案在于传统的规范与行销方式,这个世纪以来整个产业系依照业者所掌控的近乎法定管制价格机制在运作,虽然竞价行为确实存在,但在大型保险业间却不普遍,主要的竞争系在争取经纪人方面,且多用各种与价格无关的方式去争取。

而大型业者的费率主要系透过产业公会与州政府管制当局协调(或依照公司所建议)来订定,讨价还价是难免的,但那是业者与政府间,而不是业者与客户间的行为。当争论结束,公司甲的价格可能与公司乙的完全一致,而法律也禁止业者或经纪人再杀价竞争。

业者与州政府协议订定的价格保障业者的获利,而当资料显示现有价格不敷成本时,政府还会与业者协调共同努力改善损失的状况,故产业大部份定价的举动皆能确保公司有利可图,最重要的是不同于一般商业社会运作的习惯,保险公司即使在超额供给的情况下,仍能合法地调整价格以确保公司的获利。

但好景不常,虽然旧有的制度仍在但组织外的资金入续投入市场,迫使所有的参与者,不论新旧皆被迫响应,新进者利用各种不同的行销管道且毫不犹豫地使用价格作为竞争的工具,而确实他们也善用这项武器,在过程中消费者了解到保险不再是不二价的行业,而关于这点他们永远记得。

产业未来的获利性取决于现今而非过去竞争的特性,但许多经理人很难体认到这一点,不是只有将军才会战到最后一兵一卒,大部份的企业与投资分析都是后知后觉,但我们却看得很透澈,惟有一种情况才能改善保险业承保获利的状况,这和铝、铜或玉米生产业者相同,就是缩小供给与需求之间的差距。

而不幸的是不像铝、铜,保单的需求不会因市场紧峭而一下子就大幅增加,所以相对的,须从紧缩供给面来下手,而所谓的供给实际上是偏向心理面而非实质面的,不须要关闭厂房或公司,只要业者克制一下签下保单的冲动即可。

而这种抑制绝不会是因为获利不佳,因为不赚钱虽然会使业者犹豫再三但却不愿冒着丧失市场占有率与业界地位而放弃大笔的生意。

反而是需要自然的或金融上的大风暴才会使业者大幅缩手,而这种情况或许明天就会发生,也或许要等上好几年,到时即使把投资收益列入考量,保险业也很难有获利的情况。

当供给真正的紧缩时,大笔的业务将会捧上门给幸存的大型业者,他们有能力也有通路能够吃下所有生意,而我们的保险子公司已准备好这一天的到来。

在1982年我们的保险部门承销成绩恶化的比同业还严重,从获利优于同业滑落成同业平均之下,主要的变动在于国民保险传统的承保范围,我们以往获利颇佳的部份,价格下跌到保险公司铁定赔钱的惨况,而展望明年,我们预期表现将与同业水准相当,不过所谓的水准将会很惨。

我们两位明星,Cypress的Milt Thornton与Kansas的Floyd Taylor表现持续看好,维持一惯的积极态度并建立在节省成本与客户至上的企业文化上,这明白显现在他们的得分记录上。

在1982年母公司负责管理保险子公司的责任交给Mike Goldberg,自从Mike从我手中接棒后,不论在计划、招募与监控上皆也明显进步。

盖可保险持续以追求效率与客户服务的热诚为管理宗旨,而这点也保证公司非凡的成功,Jack Byrne与Bill Snyder成就人类最微妙的目标-让事情单纯化并牢记你所欲达成的目标,加上业界最优秀的投资经理人Lou Simpson,我们很满意这种最佳组合,盖可是前面我们所提及过度供给的大众化商品高获利特殊情况的最佳典范,它是一家具有既深且广的成本优势的公司,我们在该公司35%的权益代表约二亿五千万的保费量,远大于我们直接取得的数量。

〔译文基于梁孝永康所编《巴菲特致合伙人+致股东的信全集》修改完善〕