巴菲特致股东的信(1985年)

②报告收益来源

报告收益来源

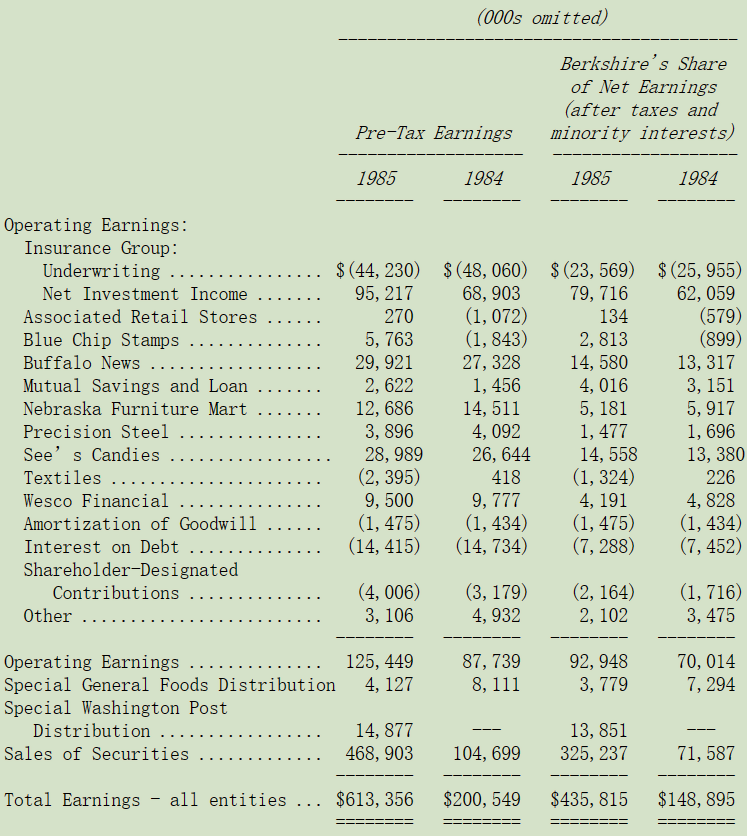

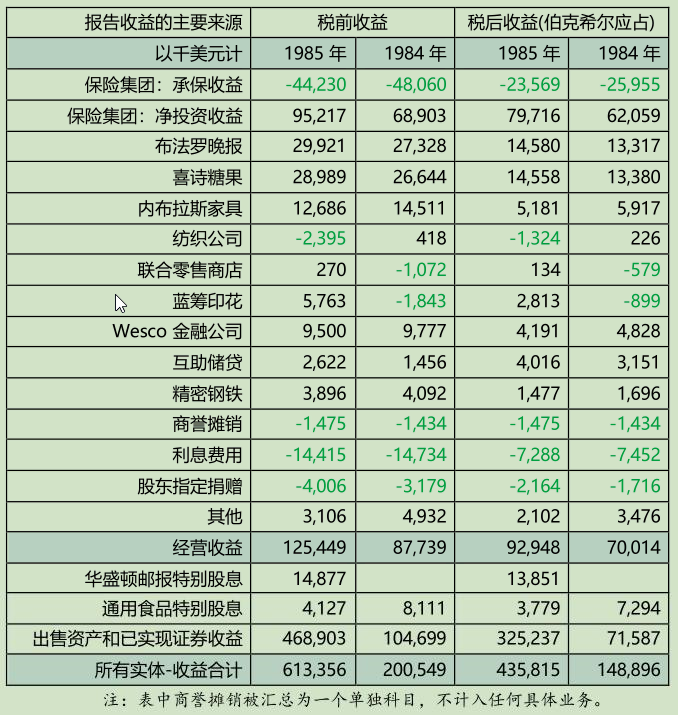

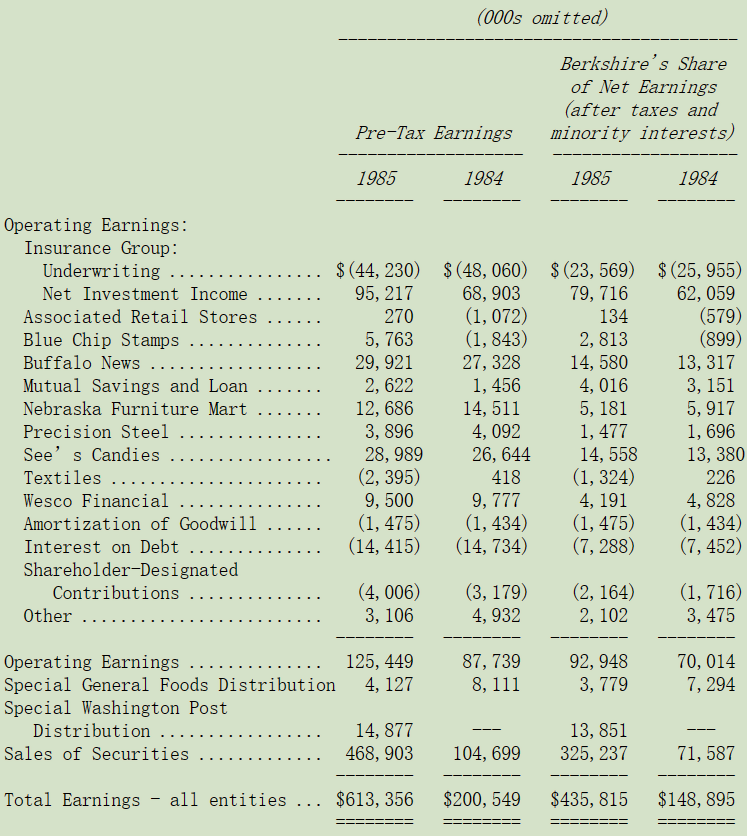

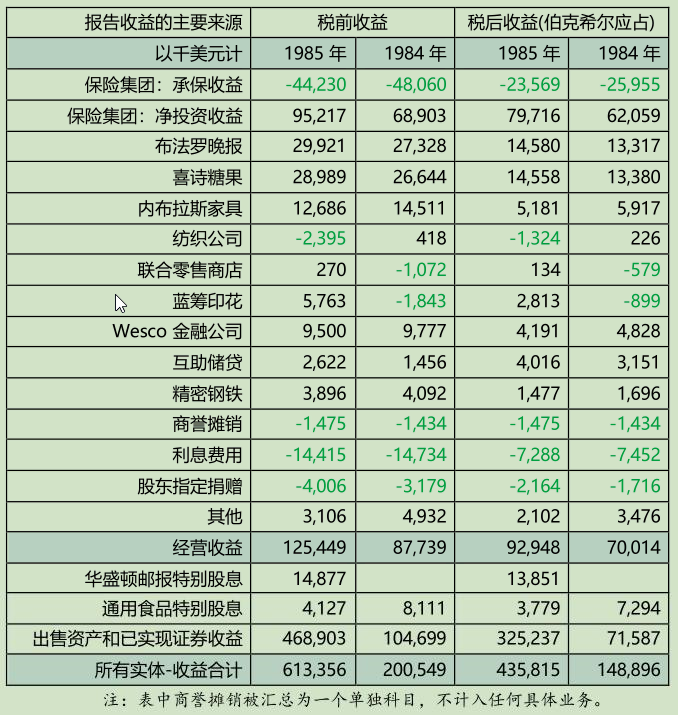

下表显示伯克希尔报告收益的主要来源,这些数字加上一些更详细的各部门信息是查理跟我关注的重点,反而我们不认为合并的总数对于管理与评估伯克希尔有什么帮助,事实上我们内部本身从来不会用到。

细分业务信息对于想要了解一家多元化公司发展情况的投资人来说同等重要,企业管理层在并购一家公司时通常也是基于这些信息作出决策,但最近这几年,他们很少将这些信息提供给决定买进卖出股权的投资者,相反当股东想要了解公司的经营情况要求管理层提供数据时,他们通常以可能危害公司利益来回答,直到最后证监会下令公司须披露细分业务数据,管理层才报告出来,这种态度的转变让我想起 Al Capone 的一个比喻:拿着一支枪好好的说比光是好好的说,效果要好上很多。

在表中,商誉的摊销不从具体业务中扣除,而是作为一个单独项目汇总,原因在我1983年年度报告附录中概述。(如有需要,可索取1977-1984年信件的摘要。)于第39-41页及49-55页的业务分部数据及管理层讨论部分,提供有关我们业务的许多额外资料,包括各分部的商誉及商誉摊销数字。我敦促你阅读这些部分以及查理·芒格(Charlie Munger)给韦斯科银行股东的信,这封信始于第56页。

1985 年业绩包含出售证券异常高的收益,但事实上不代表今年就是丰收的一年(虽然事实上的确如此),出售证券收益就好象大学毕业典礼一样,四年来所学的知识在那一天正式被认可,而当天你可能一点长进都没有。我们可能持有一支股票长达十年之久,这期间其价值与价格可能以稳定的步调增长,可是在我们真正出售的那一年其价值可能一点也没变甚至还可能减少,但自购买以来累积的所有价值增长,都将反映在出售年度的会计报表中,但如果持有股票的是我们的保险子公司,其每年市价的变动将会按要求反应在帐面之上。总而言之,任何给定年份报表上的资本损益根本无法反映我们当年度的实际表现。

1985 年大部分已实现的资本收益来自我们出售通用食品(General Foods)的股票,(税前收益 4.88 亿美元中的 3.38 亿美元,1980-85 年,累计买入 1.64 亿,盈利 3.38 亿,股息 0.11 亿,年化 25.6%)。我们从 1980 年开始便持有其大部分,我们当初以远低于我们认为合理的每股商业价值的价位买进,年复一年,在 Jim Ferguson 与Phil Smith 管理层的优异表现大幅提升该公司的商业价值。去年秋天,菲利普·莫里斯(Philip Morris)对该公司提出并购要约,报价合理反映了公司的真实的内在价值。我们的获利基于四项要素:(1)便宜的买进价格,(2)优秀的商业模式,(3)专注于股东利益且勤奋能干的管理层,(4)愿意支付完全商业价值的买家。虽然最后一项是这项获利能够一举实现的惟一因素,但我们认为,能识别出前三项的能力才是为伯克希尔股东创造价值的根本因素。在选择股票时,我们专注于如何漂亮的买进,而不是漂亮的卖出。

今年我们又再度收到来自华盛顿邮报以及通用食品的特别股息,通用食品这笔交易是发生在菲利普·莫里斯提出并购要求之前。这种特别股息是由于公司按比例的回购我们的持股产生的,回购合约中确定的交易数量是保证公司的持股比例维持不变,这类交易被国税局认定为类似发放股息,因为我们作为股东是在保证持股比例不变的前提下收到的现金。这种税收待遇对我们有利,因为与个人纳税人不同,企业纳税人对股息收入的税率比对长期资本收益的收入低得多。(若国会通过的税收法案正式成为法律,这种差异可能会进一步扩大:相关条款规定企业实现的资本利得所适用税率与一般所得相同),然而会计原则对于这类交易在财务报表上应如何处理却无统一看法,为与去年作法一致,在财务上我们仍将之视为资本利得。

虽然我们不刻意寻求此类交易,但当管理层提出这种想法时,我们通常站在支持的立场,虽然每次我们都觉得那些选择不卖的股东(当然大家都有权利以我们收到的价格出售)将因公司以低于内在价值的价格回购而受惠。但我们获得的税收优惠以及希望与管理层合作为所有股东增加价值的愿望,使得我们不得不接受回售股份,这仅限于我们的持股比例不变的原则之下。

通常讲到这里接下来要谈的是,我们经营的主要业务,在开始之前,让我们先看看我们旗下事业的一项失败。我们的副主席查理·芒格,总是强调研究失败要比研究成功重要的多,无论是商业上还是人生的各个方面。他这样的精神正如有人说: 我只想知道我会死在哪里,我将永远不会去那里。你可能马上就会明白,为什么我们两个能成为好搭档:查理喜欢研究错误,而我为他提供了足够的材料,尤其是在纺织与保险业务方面。

〔译文源于芒格书院整理的巴菲特致股东的信〕