巴菲特致股东的信(1985年)

⑦股票投资

股票投资

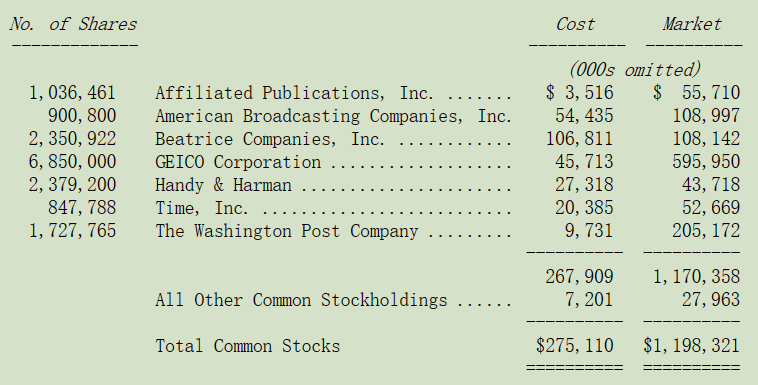

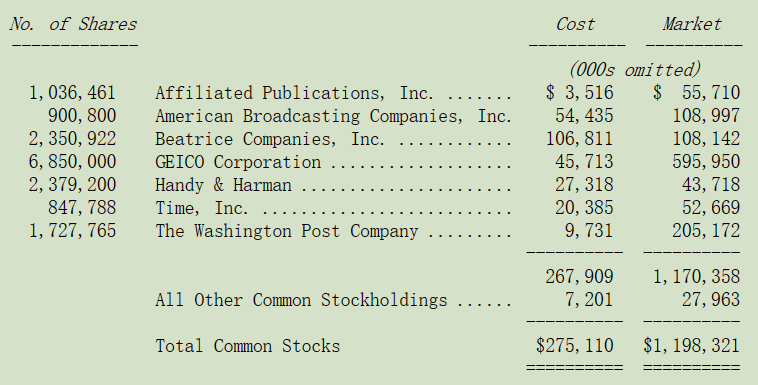

我们在 1985 年年底的有价证券净持有量在下表显示。 所有市值超过 2500 万美元的头寸均已列示,不包括归属于 Wesco 和 NFM 少数股东的权益。

我们之前曾提到,过去十年来投资环境已从一个伟大企业完全不受重视转变成适当认可的环境,华盛顿邮报WPC 就是一个最好的例子。

我们在 1973 年中以不到当时内在价值四分之一的价格买进 12%股权,计算价格/价值比并不需要独到的见解,大部分的证券分析师、经纪人与媒体经营者跟我们一样估计该公司的价值约在 4-5 亿美元之间,但当时其仅 1 亿的市值却是天天可见。相反,我们的优势在于态度:我们从本杰明.格雷厄姆那里学到,成功投资的关键是,在市场价格大大低于潜在商业价值的情况下买下优质企业的股票。

在 1970 年代早期,大部分的机构投资人在考量买进卖出的价格时,认为与其商业价值并无太大相关性,现在看来似乎令人难以置信。然而当时他们受到知名的商学院所提出的新理论所惑:股票市场是完全有效的,因此计算企业的价值对于投资活动一点也不重要。我们非常感谢这些学者:在不管是桥牌、国际象棋还是选股等智力竞赛中,当对手被教导思考是白费力气时,还有什么比这更有利的?

在 1973-1974 年间,华盛顿邮报表现依旧良好,内在价值持续增加。尽管如此,我们的持股市值却由原始成本的 1060 万减少 25%变成 800 万美元,一年前我们认为便宜得离谱的东西现在变得更便宜了。仅仅一年,具有无比智慧的市场使得 WPC 的市值跌至内在价值的 20%。

美好的结局可以预知,华盛顿邮报的总裁凯瑟琳.格雷厄姆(Kay Graham)具备提升内在商业价值极佳的管理技能,更是有智慧有勇气的以便宜的价格大量买回公司的股份。在此同时投资人开始认识到公司非凡的竞争优势,股价迅速回升到合理的价位。所以我们经历了价值三击:一击来自公司内在商业价值的增长,二击来自每股所代表的价值因公司回购大幅增加,三击来自估值的提升,股价表现大幅超越公司内在价值的实际增长。

除了 1985 年因公司依持股比例回购卖回给公司的股份外,1973 年以来的持股皆未变动,年底持股的市值加上回购所得的收入合计为 2.21 亿美元。

假若当初在 1973 年中期我们将 1060 万投资于当时最受青睐的六大媒体公司之一,那么年底我们持股的市值大约会在 4000-6000 万元之间,即使这个表现也远远超过一般市场的收益,其原因在于媒体行业非凡的竞争力,我们通过 WPC 获得的额外 1.6 亿美元左右则完全归功于凯瑟琳管理决策的优越性,虽然她惊人的事业成就并未有人大幅报导,但伯克希尔的所有股东却不能不加以珍惜。

大都会的收购,要求我必须在 1986 年离开华盛顿邮报的董事会,但只要 FCC 法令许可我们将无限期的持有华盛顿邮报的股份。我们预计该公司的价值将持续稳定成长,我们也知道公司的管理阶层非常能干且完全以股东的利益为导向,公司的市值目前已增加为 18 亿美元,公司的价值很难再以当初市值仅一亿美元时的速度成长。由于我们其它主要持股的市场股价大多已很高,所以我们的投资组合面临大幅下降的压力。

或许你会发现年底我们持有一大笔 Beatrice 公司的股份,这是一笔短期的套利动作,算是闲置资金暂时的去处,虽然不是 100%安全,因为有时也会套利失败导致重大的损失。我们有时也会在钱多于想法时进入套利领域,但我们只参与已公告宣布的案子,当然若能为这些资金找到更长期可靠的归宿我们会更高兴,但现阶段却找不到任何合适的投资对象。

年底,我们旗下保险子公司大约持有 4 亿美元的免税债券,其中 1.94 亿是华盛顿公用电力供应系统 WPPSS发行的债券,该公司我已于去年详尽的说明同时也解释在事情尘埃落定之前我们为何不愿进一步说明公司的进出动作,就像我们投资股票时一样,到年底我们在该债券的未实现投资收益为 6200 万美元(市值从 1.32 亿上涨至1.94 亿),三分之一的原因是由于债券价格普遍上涨,其余则是投资人对于 WPPSS 一、二、三期计划有较正面的看法,我们每年从该投资所获得的免税利息收益大约为 3000 万美元。

〔译文源于芒格书院整理的巴菲特致股东的信〕