巴菲特致股东的信(1987年)

②报告收益来源

报告收益来源

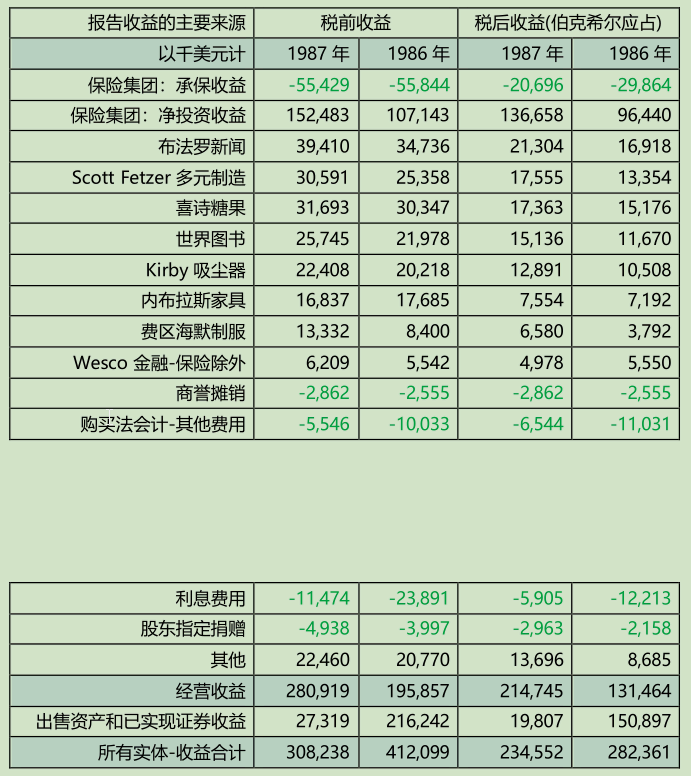

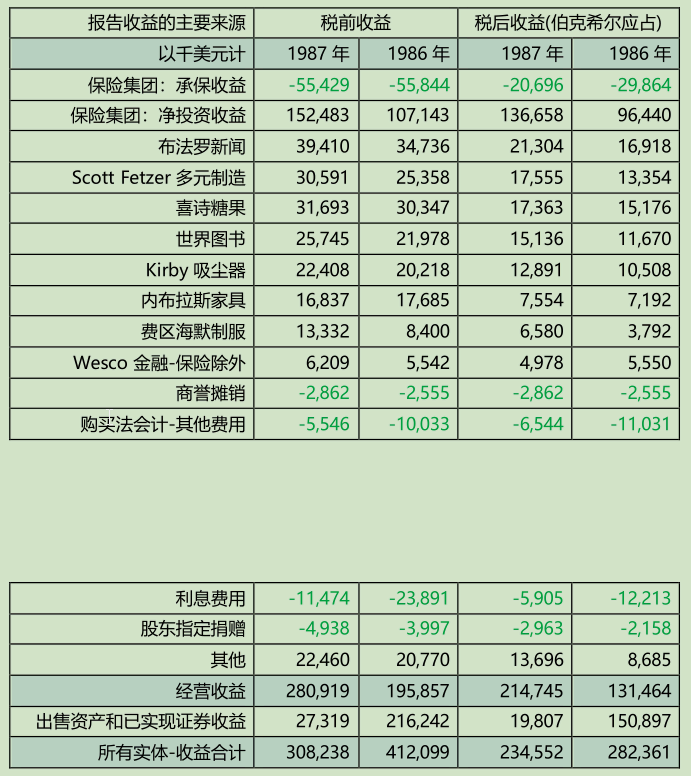

下表显示伯克希尔主要报告收益的来源,其中商誉的摊销与购买法的会计调整数,从各个企业单独摘出汇总成单独一栏,事实上这样的目的是为了让旗下业务的经营绩效,不因我们买下他们而有所影响,在 1983 与 1986年的年报中,我已不只一次的解释这样的表达方式会比依照一般公认会计原则更符合管理层与投资者的需要,当然最后加总结算的数字,还是会与会计师出具的财务报表上的收益数字完全一致。

在后面的分部门信息和管理层讨论中,大家可以找到各个业务的详细信息,除此之外,我也强烈建议大家一定要看查理写给 Wesco 股东叙述其旗下事业情况的一封信。

我们旗下这些业务实在是没有什么新的变化可以特别报告的,所谓没有消息就是好消息,剧烈的变动通常不会有特别好的绩效,当然这与大部分的投资人认为的刚好相反,大家通常将最高的市盈率给予那些擅长画大饼的企业,这些美好的远景会让投资人不顾经营现实,而一昧幻想未来可能的获利美梦,对于这种爱做梦的投资人来说,任何路边的野花,都会比邻家的女孩来的具吸引力,不管后者是如何贤慧。

然而,经验表明,最好的商业回报,通常是由那些今天正在做的事情与五年或十年前非常相似的公司来实现的。但管理者不能因为这样就固步自封。企业总是有机会改善服务、产品线、制造技术等,显然应该去抓住这些机会。但是,一个不断遭遇重大变化的企业也会遇到很多犯大错的机会。此外,永远剧烈变化的经济领域是难以建立堡垒式商业特许经营权的,这样的特许经营权通常是持续高回报的关键。

先前提到《财富》杂志的研究,可以充分支持我的论点,在 1977-1986 年间,总计 1,000 家公司中只有 25家能够达到连续十年平均股本回报率达到 20%的标准,且没有一年低于 15%的双重标准,而这些优质企业同时也是股票市场上的宠儿,在所有的 25 家中有 24 家的表现超越标普 500 指数。

这些财富之星可能在两个方面让你大开眼界,首先,虽然本身有支付利息的能力,但他们所运用的财务杠杆极其有限,一家真正好的公司是不需要借钱的。第二,除了有一家是所谓的高科技公司,另外少数几家属于制药业以外,大多数的公司产业相当平凡普通,大部分现在销售的产品或服务与十年前大致相同,(虽然数量或是价格、或是两者都有,比以前高很多)。这些公司的记录显示,充分运用现有的强大特许经营权,或是专注在单一领导的产品品牌之上,通常创造出非凡的经济效益。

事实上我们在伯克希尔的经验正是如此,我们的专业经理人所缔造出优异的成绩,是通过把相当平凡的业务做到极致实现的,经理人致力于保护企业特许经营权、控制成本,基于现有能力寻找新产品与新市场来巩固既有优势,他们从不受外界诱惑,巨细靡遗地专注于企业细节之上,而其成绩有目共睹。

以下是近况报导:

o 阿加莎·克里斯蒂小姐嫁给一位考古学家,她曾说:“配偶最理想的职业就是考古学家,因为你越老,他就越有兴趣。”事实上应该是商学院而非考古学系的学生,需要多多研究 B 夫人-这位内布拉斯加家具店 NFM 高龄 94岁的经理人。

50 年前,B 夫人以 500 美金起家,如今 NFM 已是全美最大的家居品商店,但 B 夫人还是一样从早到晚,一个礼拜工作七天,掌管采购、销售与管理,一轮又一轮的直面竞争。我很确定她现在正蓄势待发,准备在未来的五到十年内,全力冲刺再创高峰,也因此我已说服董事会取消一百岁强迫退休的政策,(也该是时候了,随着时光的流逝,越来我越相信这个规定是该修改了)。

1987 年 NFM 的销售净额是 1.426 亿美元,较去年增长 8%,全美没有那家店能与之相比,全美也没有那个家族能与之相比,B 夫人家族三代都拥有天生的生意头脑、品格与冲劲,且分工合作,团结一致。

B 夫人家族的杰出表现,不但让身为股东的我们受益良多,NFM 的客户们受惠更大,他们在 1987 年通过购买 NFM 的产品就省下约 3000 万美元,换句话说,若客户到别处去购买,可能要多花这么多钱。

去年 8 月我收到一封匿名信:“很遗憾看到伯克希尔第二季度获利下滑,想要提高贵公司的获利吗?有一个不错的法子,去核实一下 NFM 的产品售价,你会发现他们把 10-20%利润白白奉送给客户,一年 1.4 亿的营业额,那可是 2800 万的利润,这个数字实在是相当可观。再看看别家家具、地毯或是电器用品的价格,你就会发现把价格调回来是再合理不过了,谢谢!来自一位竞争同业。”

展望未来,NFM 在 B 夫人“价格公道实在”座右铭的领导下,必将继续成长茁壮。

o 在全美规模相当或更大的报纸中,布法罗新闻报在两个重要方面继续领先:第一,在工作日与周日的渗透率最高(即订户数在该地区家户数的比率),第二,是新闻比率最高(新闻版面占总版面的比率)。

事实上一份报纸能够同时拥有这两项特色绝对不是巧合,因为新闻内容越丰富,也就越能吸引更广泛的读者,从而提高渗透率,当然发行数量必须与新闻品质相匹配,这不但代表要有优秀的报导与编辑,也代表要有新闻性与关联性。为了让报纸成为读者们不可或缺的东西,它必须能够马上告诉读者许多他们想要知道的事情,而不是等读者们都已知道后,事后报纸才刊登出来。

以布法罗新闻报来说,我们平均每 24 小时出七个版本,每次内容都会更新,举一个简单的例子就足以让人感到惊奇,光是每天的讣文就会更新七次,也就是说每则新增的讣文会在报纸上连续刊登七个版。

当然一份新闻也必须要有有深度的全国与国际性新闻,但一份地区性的报纸也必须及时并广泛地报导社区动态,要把这点做好除了需要非常广泛的新闻源,还必须要有足够的版面空间,并加以有效地运用安排。

1987 年,我们的新闻比一如既往的是 50%,若是我们把这比率砍到一般 40%的水准,我们一年约可省下400 万美金的新闻成本,但我们从来都不会考虑如此做,就算哪一天我们的获利大幅缩减也是一样。

这些做法对我们毫无意义。我们既不理解有些公司因为赚太多钱而增加不必要的人事来消化预算,也不理解因为获利不佳就砍掉一些关键的人事。这种变来变去的方式既不符合人性也不符合商业原则,我们的目标是不论如何都要做对伯克希尔的客户与员工有意义的事,永远不要添加不必要的东西。(你可能会问那公司的商务飞机又是怎么一回事?嗯!我想有时一个人总会有忘了原则的时候)。

虽然布法罗新闻报的营收最近几年只有略微的增长,但在发行人 Stan Lipsey 杰出的管理之下,获利却反而大幅增长,几年来我甚至错误地预测该报的获利会下滑,但今年我的预测不会让大家失望,1988 年不管是毛利或者是净利都会缩水,其中新闻纸成本的飞涨是主要的原因。

o 费区海默兄弟公司是我们旗下另一个家族企业,而就像 Blumkins 一样,是个非常杰出的家族,几十年来,海德曼家族三代,努力不懈地建立了这家制服制造与销售公司,而在伯克希尔取得所有权的 1986 年,该公司的获利更创新高,此后 Heldmans 家族并未停下脚步, 1987 年收益又大幅增加,而展望 1988 年前景更是看好。

制服业务实在没有什么神奇之处,唯一的惊奇就是 Heldmans 家族,Bob、George、Gary、Roger 和 Fred对于这行业了如指掌,同时也乐在其中,我们何其有幸能与他们一起合作共事。

o 查克·哈金斯(Chuck Huggins)持续为喜诗糖果缔造新的记录,自从 16 年前我们买下这家公司,并请他主掌这项业务时,便一直是如此。在 1987 年糖果销售量创下近 2500 万磅的新高,同时连续第二年,单店平均销售磅数维持不坠,你可能会觉得没什么了不起,事实上这已是相当大的改善,因为过去连续六年都呈现下滑的趋势。

虽然 1986 年的圣诞节特别旺,但 1987 年圣诞节的记录还要更好,这使得季节因素对喜诗糖果来说越来越重要,经统计,去年一整年约有 85%的获利是在十二月份单月所创造的。

糖果店看着很有趣,但对大部分的老板来说就不那么有趣了,就我们所知,这几年来除了喜诗赚大钱之外,其它糖果店的经营皆相当惨淡,所以很明显的喜诗搭的并不是顺风车,它的表现是扎扎实实的。

这项成就当然需要优秀的产品,这个倒不是问题,因为我们确实拥有,但除此之外它还需要对客户衷心的服务,Chuck 可以说是百分之百地以客户为导向,而他的服务态度更是直接感染到公司上下所有的员工。

以下是一个具体的例证,在喜诗,我们通常会定期增添新的口味并剔除旧的口味以维持大约一百个品种。去年我们淘汰了 14 种口味,结果其中有两种让我们的客户无法忘怀,而不断地表达他们对我们这种举动的不满,“愿喜诗所有做出这种可恶决定的相关人士受到谴责;愿你们的巧克力在运送途中融化;愿你们吃到酸败的糖果;愿你们亏大钱;我们正试图寻求要求你们恢复供应原有口味的法院强制令……”有画面感了吧,总计最后我们收到好几百封这种抱怨信。

为此 Chuck 不但重新推出原来的口味,他还将危机化为商机,所有来信的客户都得到完整且诚实的回复,信上是这样写的:“虽然我们做出了错误的决定,但值得庆幸的是,好事因此而发生……”,随信还附赠一个特别的礼券。

过去两年喜诗糖果仅稍微地涨价,在 1988 年我们进一步调涨价格,幅度还算合理,只是截至目前为止销售持续低迷,预计今年公司收益将难再有继续成长的可能性。

o 世界图书公司、柯比吸尘器与斯科特费泽制造集团皆由拉尔夫·谢伊(Ralph Schey)所领导,很高兴我们能做这样的安排,去年我曾告诉各位斯科特费泽集团在 1986 年的表现远超查理和我的购买预期,1987 年的表现甚至更为出色,税前收益增长了 10%,但平均使用资本却较前年大幅缩减。

Ralph 同时掌管 19 项业务的方式实在是令人叹为观止,同时他也吸引了一群优秀的经理人协助他经营业务,我们很乐意再多找一些业务交到 Ralph 旗下去经营。

由于斯科特费泽的业务范围过于繁杂,在此不便详述,这里谨就我们的最爱《世界百科全书》加以介绍,去年底,世界百科全书推出自 1962 年以来最引人注目的修订版本,全套书中的彩色照片从 14,000 祯增加到24,000 祯,超过 6,000 篇文章重新编写,840 位作者参与;查理跟我衷心向您与您的家庭推荐包含《世界百科全书》与《儿童手工》等一系列早教产品。

在 1987 年世界图书在美国地区销售量连续第五年成长,国际销量与获利亦大幅增加,斯科特费泽集团前景看好,尤其世界百科全书更是如此。

〔译文源于芒格书院整理的巴菲特致股东的信〕