巴菲特致股东的信(1987年)

③保险业务营运

保险业务营运

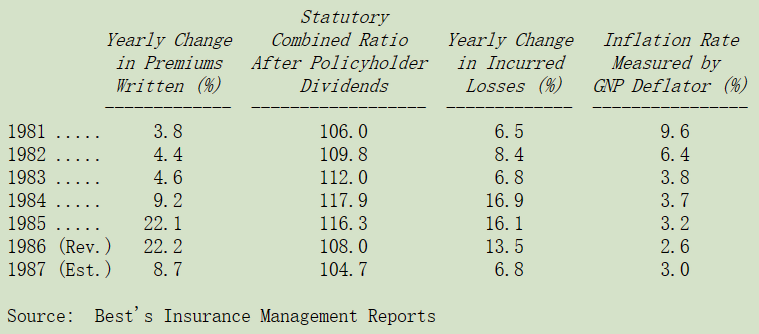

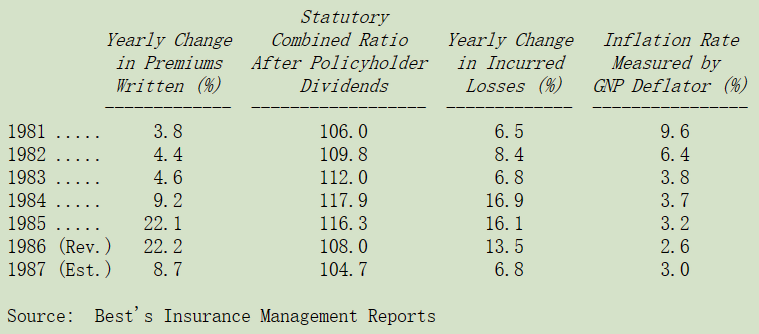

下表是我们常用保险业主要指标的最近更新数字:

综合比率代表所有保险成本(发生损失加上承保费用)占保费收入的比率,一百以下表示承保获利,一百以上则表示承保亏损,若考量保险公司利用保费收入(浮存金)所赚取的投资收益列入计算,则 107 到 111 之间大约是损益平衡点,当然这是不包含公司自有资金所运用的收益。

保险业务的数字,若以上面那张简表来说明,事实上并不复杂,当同业平均保费收入年增长只在 4-5%徘徊,则当年承保损失一定会上升,原因不在于车祸、火灾、暴风等意外事件发生更频繁,也不是因为一般通货膨胀的关系。罪魁祸首在于今天社会与司法的过度膨胀,法律诉讼费用暴增,一方面是因为诉讼更频繁,一方面是由于陪审团与法官倾向扩大保险单上的保险理赔范围,若这种乱象不能加以抑止,则保险公司每年至少要有 10%以上的保费收入增长,才有办法收支打平,即使在通货膨胀相对温和的状况下也是如此。

过去三年来保费收入的大幅成长几乎可以确定今年同业的绩效都会相当不错,事实证明也是如此,不过接下来的情况可就不太妙了,根据 Best's 统计预估,1988 年的按季增长率为 12.9%、11.1%、5.7%、5.6%,可以确定的是 1988 年的保费收入增长一定会低于 10%的损益两平点,很显然,好日子已经结束了。

然而收益数字却不会马上滑落,这个产业具有滞后现象,因为大部分的保单都是一年期,因此更高或更低的保单价格在生效后几个月内不会对收益产生全部影响,所以对损益的影响会在往后的一年之间陆续浮现。因此打个比方,在 party 结束、酒吧关门之前,你还可以把手上的那杯喝完了再走,假设往后几年没有发生什么重大自然灾害,我们预期 1988 年的同业平均综合比率将会微幅上扬,紧接下来的几年则会大幅攀升。

保险业最近受到几项不利的经济因素所困而前景黯淡:数以百计的竞争对手、进入门槛很低、无法大幅差异化的产品特性。在这种类似商品型产业之中,只有低成本营运的公司或是一些受到保护的利基产品才能维持长期高获利的水平。

当产品供给短缺时,即使是大宗商品产业也能蓬勃发展,不过在保险业界,这种好日子早就已经过去了,资本主义最讽刺的地方就是大宗商品型产业大部分的经理人都痛恨商品短缺不足,但偏偏这是唯一可能让这些公司有良好获利的环境。当短缺出现时,经理人便会迫不及待地想要扩充产能,这无异是将源源不断流入现金的水龙头关掉一样,这就是过去三年保险公司经理人的最佳写照,再次验证 Disraeli 的名言:“我们唯一从历史得到的教训就是我们从来无法从历史中得到教训!”

在伯克希尔,我们努力避免自己的公司成为大宗商品型企业。首先我们凭借着自己强大的资金实力,来凸显我们产品的不同,但这种效果实在是有限。尤其在个人险的部分,因为即使是其所投保的保险公司倒闭(事实上这种状况还不少),汽车险或或房屋险的购买者仍可获得理赔。在商业险的部分也是如此,当情况好时,许多大企业投保户与保险经纪人都不太关心保险业者的财务状况,即使是比较复杂的案件,顶多拖个三、五年,最后还是有办法可以解决(眼不见为净的结果,可能会让你的口袋落空)。

不过,保户定期也会想起富兰克林所说:空袋子很难立起来,并认识到寻找一个可靠稳定的保险公司的重要性。这时我们发挥优势的机会就来了,当客户认真想到往后五到十年,若是面对景气不佳同时又碰上金融市场低迷,再保业者倒闭频繁等景象时,而怀疑保险公司是否仍有能力轻松地支付一千万美元理赔金时,那么他可以挑选的保险公司其实是相当有限的,在所有的保险业者之中,伯克希尔无疑是站得最直挺的一个。

我们第二种方法是,我们完全不去理会签发保单的数量,在下一个年度我们很愿意一口气签出比前一年多五倍的保单,但若是只能签发五分之一的保单也无所谓。当然情况允许,我们希望是越多越好,但我们实在是无法掌握市场价格,若价格不理想,我们就会暂时退出市场少做一点生意,在同业中再没有其它任何一家保险公司有我们如此高的自制力。

在保险业普遍存在的三种情况(这在其它产业并不多见),使得我们能保持相当的弹性。第一,市场占有率并不是盈利能力的重要决定因素:这个行业不像新闻业或是零售业,最后能够存活的不一定是市场份额最大的那个。第二,许多的保险领域,其中也包含我们所从事的主要险种,销售渠道并非专有的,所以进入障碍低,今年业绩不多,不代表明年就一定会很少。第三,闲置的产能,在保险业来说主要是在于人力,这部分并不会造成太大的负担,在印刷或是钢铁业的话就不是这样,我们可以在保持慢速前进的同时,随时蓄势待发准备向前冲刺。

我们完全以价格为导向(而非竞争)来决定我们的风险部位,因为这样做才有利于我们的股东,但同时我们也很高兴,这同样也有利于社会。这个原则代表我们随时准备就绪,只要市场价格合理,我们愿意随时进场承接任何财产意外险的保单,以配合许多保险同业遵循的进进出出的策略,当他们因为损失扩大、资本不足等原因退出市场时,我们随时可以接替,当然当一些同业进来杀价抢食市场时,虽然我们也愿意继续服务大众,但由于我们的报价高于市场价格,所以只好暂时退出观望,基本上我们扮演的是市场供需调节的角色。

1987 年中的一个事件可以充分说明我们的价格政策。在纽约有一家家族经营的保险经纪公司是由一个伯克希尔多年资深的老股东所领导,这老兄手上有许多客户是我们所想要交往的,但基于职业道德他仍然必须为他的客户争取到最好的权益,所以当保险市场价格大幅滑落,他发现我们的保费比起其它同业贵了许多时,他第一个反应就是赶快把他客户的保单从伯克希尔转移到别的保险公司,接下来第二的动作就是买进更多伯克希尔的股票,他说要是哪一天伯克希尔也一样以降价竞争作为回应,那么他就会把生意给伯克希尔做,但他可能就会把伯克希尔的股票卖光。

伯克希尔 1987 年的承保表现实在是好极了,一方面是因为先前提到的递延效应,我们的综合比率是 105%,(泛指一般保单,不包含结构化结算和金融再保险部分),虽然这个数字比起 1986 年的 103%来说略微逊色,但我们在 1987 年的获利能力却大幅提高,因为我们有更多的浮存金可以运用。这一趋势将会持续保持,在往后几年我们浮存金对保费收入的比例还是继续增加,所以展望伯克希尔 1988 年与 1989 年的获利仍将大幅成长,尽管预估的综合比率亦会上升。

我们的保险业务去年在非财务方面亦有重大的斩获,我们组织了一支训练有素的专业团队,专门承保特殊巨额的风险,他们已准备好帮助我们处理任何可能遇到庞大的商机。

有关损失准备金提列的情况,详附表,今年的状况比前几年好一点,但由于我们承保了许多长尾业务,许多理赔申请通常要花上好几年才能解决,就像是产品责任保险,或专业经理人责任险,在这种特殊的产业,一年的损失准备其实无法是代表最后结果。

大家应该对保险公司的收益数字时时抱持怀疑的态度,(当然也包含我们自身,事实证明确是如此),过去十年来的记录显示,有许多显赫一时的保险公司报告给股东亮丽的收益数字,最后证明只不过是一场空,在大部分的情况下,这种错误是无心的,我们诡谲多变的司法制度,使得就算是最有良知的保险公司都无法准确预测这类长期保险的最终索赔成本。

但奇怪的是,会计师每年就是有办法为就这些管理层给的数字背书,并出具无保留的意见表示这些数字公允的表达了该公司的财务状况,而事实上他们自己深知过去惨痛的经验告诉他们,这些经过验证的数字与最后可能结算出来的结果可能会有天壤之别,但却还是仍然使用这种坚定的语言。而从另一方面来说,尽管这样错误的历史在前,投资人却还是相当仰赖会计师的意见,对于会计门外汉来说,他根本就不懂得“该财务报表公允表达”,所代表的真正含意是什么。

会计师标准无保留意见查核报告的遣词用语在明年将有重大改变,新的用语有相当的改进,但还是很难充分说明财产意外险公司在查核时所受到的限制,如果一个人想要描述一件事情的真相,我们认为给财产意外险公司股东的标准无保留意见报告中应这样写:“我们仰赖管理层提供损失准备与损失费用调整产生财务报表,而这些估计数字事实上影响公司收益与财务状况甚巨,受限于损失准备的提列先天信息的不足与我们必须提出的意见,我们完全无法对这些数字的正确性表达看法,等等”。

假若有人对这种完全不正确的财务报表提出诉讼官司(事实上就有),会计师一定会在法庭上做类似的辩解,那么他们为什么不一开始就坦白地说明他们真实的角色与所受的限制呢?

我们想要强调的是,我们并不是怪罪会计师没有办法准确地评估损失准备(当然这会影响到最后的收益数字),我们无法原谅的是他们没有公开地承认做不到这一点。

从各种不同的角度来看,这种不断在提列损失准备时所犯的无心错误,往往也伴随着许多故意的过失。许多骗子就是看准会计师没有能力评估这些数字,同时又愿意配合为这些数字背书,假装好象他们真的有这个能力。靠着这种方式来欺骗投资大众赚大钱,在往后的日子我们仍将看到这样的骗局持续上演,在“收入”可以通过笔触创造的地方,不诚实的人就会聚集起来。对他们来说,长尾保险就是天堂。前述我们建议的审计报告措词,至少可以让无知的投资人提高警觉避免遭到这些掠食者的坑杀。

去年在年报中详述刚通过的《税收改革法案》,使得保险公司支付的税负以递延渐进的形式大幅增加,这种情况在 1987 年更加恶化,讽刺的是虽然这个法案大大地影响到保险公司长期的获利能力与商业价值,却让保险公司短期的收益数字格外亮丽,光是在伯克希尔 1987 年的收益就增加了 820 万美金。

就我们个人的看法,1986 年的法案是近十多年来保险业界最重要的经济事件,1987 年的新法案进一步将企业间股利可扣抵的比率由 80%减为 70%,除非纳税人拥有被投资公司超过 20%的股权。

投资人通过中间企业法人(除了专业投资公司外)间接持有的股份或债券,一直就比直接持有这些有价证券要来的不利的多,尤其是在 1986 年租税改革法案通过后,这种对间接所有权的租税惩罚更为明显,虽然 1987 年的情况稍微好转一点,特别是中介人是保险公司的情况。我们没有任何方法可以规避这项增加的税负成本,简而言之,现在同样的税前获利,在扣除税负成本后最后所得到的税后净利,要比过去要来得少的多。

不论如何,我们期望保险业务表现良好,只是最后的成绩可能无法像过去那么好,目前的展望是保费收入将减少,尤其是消防人员基金份额保险协议在 1989 年到期后,但收益可略微改善,之后我们可能可以再遇到好机会,不过那可能要好几年以后,届时我们应该可以作好更万全的准备。

〔译文源于芒格书院整理的巴菲特致股东的信〕