巴菲特致股东的信(1987年)

④有价证券-永恒的持股

有价证券 - 永恒的持股

每当查理跟我为伯克希尔旗下的保险公司买进股票(扣除套利交易,后面会再详述),我们采取的态度就好象是我们买下的是一家私人企业一样,我们着重于这家公司的经济前景、管理层以及我们支付的价格,我们从来就没有考虑再把这些股份卖出,相反地只要能够预期这家公司的价值能够稳定地增加,我们愿意无限期地持有这些股份,在投资时我们从不把自己当作是市场的分析师、总体经济分析师或是证券分析师,而是企业的分析师。

我们的方式在交易活跃的股票市场相当管用,因为市场不定期地就会突然浮现令人垂涎三尺的投资机会。但交易市场绝不是必需的,因为就算是我们持有的股票停止交易很长一段时间我们也不在意,就像是世界图书公司或是费区海默同样没有每天的报价,最后一点,我们的经济利益取决于我们所拥有的公司本身的经济利益,不管我们持有的是全部或者是部分股权都一样。

本杰明·格雷厄姆是我的老师,也是我的朋友,很久以前讲过一段有关面对市场波动心态的话,是我认为对于投资成功最有帮助的一席话,他说投资人可以试着将股票市场的波动当作是一位市场先生每天给你的报价,他就像是一家私人企业的合伙人,不管怎样,市场先生每天都会报个价格要买下你的股份或是将手中股份卖给你。

即使是你们所共同拥有的合伙企业具有稳定的经济特征,市场先生每天还是会固定提出报价,同时市场先生有一个缺陷,那就是他的情绪很不稳定。当他高兴时,往往只看到合伙企业好的一面,所以为了避免手中的股份被你买走,他会提出一个很高的价格,甚至想要从你手中买下你拥有的股份;但有时候,当他觉得沮丧时,眼中看到的只是这家企业的一堆问题,这时他会提出一个非常低的报价要把股份卖给你,因为他很怕你会将手中的股份塞给他。

市场先生还有一个很可爱的特点,那就是他不在乎受到冷落,若今天他提出的报价不被接受,隔天他还是会上门重新报价,要不要交易完全由你自主,所以在这种情况下,他的行为举止越失措,你可能得到的好处也就越多。

但就像灰姑娘辛蒂瑞拉参加的化妆舞会一样,你务必注意午夜前的钟响,否则一切将会变回南瓜和老鼠:市场先生是来为你服务的,千万不要受他的诱惑被他所引导。你要利用的是他饱饱的口袋,而不是平平的脑袋,如果他有一天突然傻傻地出现在你面前,你可以选择视而不见或好好地加以利用,但是要是你占不到他的便宜反而被他愚蠢的想法所吸引,则你的下场可能会很凄惨;事实上若是你没有把握能够比市场先生更清楚地衡量企业的价值,你最好不要跟他玩格雷厄姆这样的游戏,就像是打牌一样,如果你玩了 30 分钟还是没有看出谁是傻子,那么那个傻子很可能就是你!

格雷厄姆的市场先生理论在当今的投资世界内或许显得有些过时,尤其是大多数专业人士和学者在大谈市场有效理论、动态对冲与 Beta 系数时更是如此,他们会对那些深奥的课题感兴趣是可以理解的,因为这对于渴望投资建议的追求者来说,笼罩着神秘色彩的技术是相当具吸引力的,就像是没有一位巫医可以单靠“吃两颗阿斯匹宁”这类简单有效的建议成名致富的。

这当然是股市秘籍存在的价值,在我看来,投资成功不是靠神秘的公式、计算机程序或是股票行情板上股票价格的跳动。相反,投资人之所以成功,是凭借着优异的商业判断力,同时避免自己的想法和行为,受到容易煽动人心的市场情绪所影响。以我个人的经验来说,要能够免除市场诱惑,最好的方法就是将格雷厄姆的市场先生理论铭记在心。

追随格雷厄姆的教诲,查理跟我着眼的是投资组合本身的经营成果,以此来判断投资是否成功,而不是他们每天或是每年的股价变化,短期间市场或许会忽略一家经营成功的企业,但最终,这些公司终将获得市场的肯定。就像格雷厄姆所说的:“短期而言,股票市场是一个投票机,但长期来说,市场却是一个称重机。”一家成功的公司是否很快地就被市场发现并不是重点,重要的是只要这家公司的内在价值能够以稳定地速度成长才是关键,事实上,越晚被市场发现的好处多多,因为我们就有更多的机会以便宜的价格买进它的股份。

当然,有时市场也会高估一家企业的价值,在这种情况下,我们会考虑把股份出售。另外,虽然有时公司股价合理或甚至略微低估,但若是我们发现有更被低估的投资标的或是我们觉得比较熟悉了解的公司时,我们也会考虑出售股份。

然而我们必须强调的是,我们不会因为被投资公司的股价上涨或是因为我们已经持有很长一段时间,而出售股份。在华尔街名言中,最愚蠢的莫过于是“(任何方式)赚钱的人是不会破产的”,我们非常乐意无限期的持有一家公司的股份,只要这家公司预期股本回报率令人满意、管理阶层能干且正直,同时市场对于其股价没有过度的高估。

但是,这不包含我们保险公司所拥有的三家企业,即使它们的股价再怎么涨,我们也不会卖。事实上,我们把这些投资与前面那些具控制权的公司一样地看待,它们不是市场先生提出高价就可以处置的一般的商品,反而是伯克希尔企业永久的一部分。只是在此我要加一个例外:除非因为我们的保险公司发生巨额亏损,必须出售部分的持股来弥补亏损。当然,我们会竭尽所能避免这种情况的发生。

当然,查理跟我决定要拥有并持有一家公司的股份,是同时综合了个人想法与财务方面的考量,对某些人来说,我们这样的做法可能有点不合常规。(查理跟我长期以来一直遵从奥美广告创办人大卫·奥美的建议:在年轻时发展出你自己的特异风格,这样子等你到老时,人们就不会觉得你是个怪胎了)。的确,近年来在交易频繁的华尔街,我们的态度看起来有些特立独行,在那个竞技场内,所有的公司与股份,都不过是交易的筹码而已。

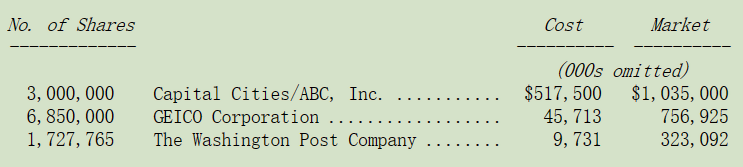

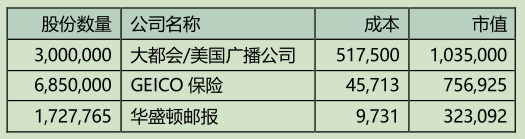

但是我们的态度完全符合我们本身的人格特质,这也是我们想要过的生活。丘吉尔曾经说过:你塑造环境,然后环境塑造你(You shape your houses and then they shape you.)。我们很清楚我们要如何去塑造我们想要的模式,因此,我们宁愿跟我们喜欢与敬佩的对象交往,也不愿为了多赚几个点回报,去跟一些我们讨厌或是不喜欢的人打交道。我想,我们大概永远不可能再找到像这三家公司中的一些主要参与者,令我们所喜爱与敬佩的人了。以下所列就是我们永恒的持股:

在这些公司上,我们实在看不出买下并控制一家企业或是购买部分股权有什么本质上的差异,每次我们都是试着去买进一些具备长期经济效益的的公司,我们的目标是以合理的价格买到绩优的企业,而不是以便宜的价格买进平庸的公司。查理跟我发现:你无法用母猪耳朵做出一个丝绸钱包(粗瓷碗雕不出细花来,朽木不可雕也)。买到货真价实的东西才是我们真正应该做的。

必须特别注意的是,本人虽然以学习快速著称,不过却花了 20 年才明白买下好企业的重要性。刚开始我努力寻找便宜的货色,不幸的是真的让我找到了一些,所得到的教训是:在农具机械公司、三流百货公司与新英格兰纺织工厂等没有前途的经济形态上,好好的上了一课。

当然查理跟我确实会误判一家企业的基础竞争力。当这种情况发生时,不管是买下全部或是部分的股权,我们都会面临了一大堆问题与挑战,当然后者要脱身相对容易一点,(确实企业很可能会被误判,一位欧洲记者被派驻到美国采访卡内基,发了一封电报给他的编辑主管说到:天啊,你一定不敢相信在这儿经营图书馆竟然可以赚那么多钱。)

在进行取得控制权或是部分股权投资时,我们不但试着去找一家好公司,同时最好是能够由品格与才能兼具且为我们喜爱的管理者经营,如果是看错了人,在具控制权的情况下,我们还有机会发挥影响力来改变,然而,实际上这种优势有点不切实际:因为更换管理阶层,就像是离婚一样,过程是相当的费时痛苦,而且要看运气。不论如何,我们三家永恒的股权投资在这点是不太可能发生的,有汤姆·墨菲和丹·伯克(Dan Burke)在大都会,比尔·斯奈德(Bill Snyder)和路易·辛普森(Lou Simpson)在 GEICO 保险,凯瑟琳·格雷厄姆和迪克·西蒙斯(DickSimmons)在华盛顿邮报,我们实在想不出有更好的接替人选。

我必须说明,控制一家公司有二个主要的优点:首先,当我们控制一家公司我们便有分配资本与资源的权力,相较之下,若是部分股权投资则完全没有说话的余地,这点非常重要,因为大部分的公司经营者,并不擅长于做资本配置,之所以如此,并不让人奇怪,因为大部分的老板之所以能够成功,是因为他们在营销、生产、工程、行政管理方面表现出色。

而一旦成为 CEO 之后,他们马上必须面临许多新的责任与挑战,包括要做资本配置的决策,这是一项他们以前从未面对,艰巨且重要的工作。打个比方,这就好象是一位深具天分的音乐家,没有安排让他到卡内基音乐厅演奏,却反而任命他为美联储主席一般。

CEO 缺乏资本配置的能力可不是一件小事,一家公司若是每年保留 10%的收益在公司的话,经过十年后,他所要掌管的资金等于增加了 60%。

某些体认到自己缺乏这方面能力的 CEO(当然也有很多不这样认为),会转向下属、管理顾问或是投资银行家寻求建议,查理跟我时常观察这种“帮助”的后果。总的来说,我们认为大多数的情况并不能解决问题,反而是让问题变得更严重。

结果你就会发现,在美国企业一大堆不明智的资本配置决策一再重复的发生,这也是为什么你常常听到组织重整再造的原因。然而,在伯克希尔我们算是比较幸运,在我们主要的不具控制权的股权投资方面,大部分的公司资金运用还算得当,有的甚至还相当的杰出。

第二项优点是,相比于部分投资,取得控制权的投资享有税收上的优惠。伯克希尔身为一家控股公司,在投资部分股权时,必须吸收相当大的租税成本,相较之下,持有 80%以上控制股权的投资则没有这种情况,这种租税弱势发生在我们身上由来已久,但过去几年的税法修订,使得这种情形更雪上加霜,同样的获利,若发生在我们持有 80%以上股权的公司,要比其它部分股权投资的效益要高出 50%以上。

不过这一劣势有时可以由另一项优势所抵消掉,有时候股票市场,让我们可以以不可思议的价格买到绩优公司部分的股权,远低于协议买下整家公司取得控制权的平均价格。举例来说,我们在 1973 年以每股 5.63 元买下华盛顿邮报的股票,该公司在 1987 年的每股收益是 10.3 元,同样地,我们分别在 1976、1979 与 1980 年以每股 6.67 元的平均价格买下 GEICO 保险的部分股权,到了去年其每股税后的经营收益是 9.01 元,从这些情况看来,市场先生实在是一位非常大方的好朋友。

一个矛盾又有趣的会计现象,从上面的表你可以看到,我们在这三家公司的市值超过 20 亿美元,但是他们在1987 年只为伯克希尔贡献了 1100 万美元税收收益。

会计原则规定,我们只能认列这些公司分配给我们的股利,这通常要比公司实际所赚的数字要少的多。以这三家公司合计,1987 年可以分配到的收益数字高达一亿美元。另一方面,会计原则规定这三家公司的股份若是由保险公司所持有,则其帐面价值应该要以其市场价格列示,结果是一般公认会计原则要求我们在资产负债表上列出这些被投资业务的实际价值,却不准让我们在损益表是反应他们实质的获利能力。

在我们具有控制权的投资业务,情况却刚好相反,我们可以在损益表上充分表示其获利状况,但不管这些资产在我们买下之后,价值在无形间如何地增加,我们也无法在资产负债表上做任何的变动。

我们应对这种会计精神分裂症的调整心态方式就是,不去理会一般公认会计原则 GAAP 所编制的数字,而只专注于这些具控制权或者是部分股权的公司其未来的获利能力。采用这种方法,我们依自己的商业价值概念建立一套企业价值的评价模式,它有别于会计帐上所显示的具控制权的帐面投资成本,以及有时部分股权投资在愚蠢市场上的市值,我们希望在未来年度,持续稳定增加这种商业价值(当然若能以不合理的速度成长的话更好)。

〔译文源于芒格书院整理的巴菲特致股东的信〕