巴菲特致股东的信(1990年)

⑤保险业务营运

保险业务营运

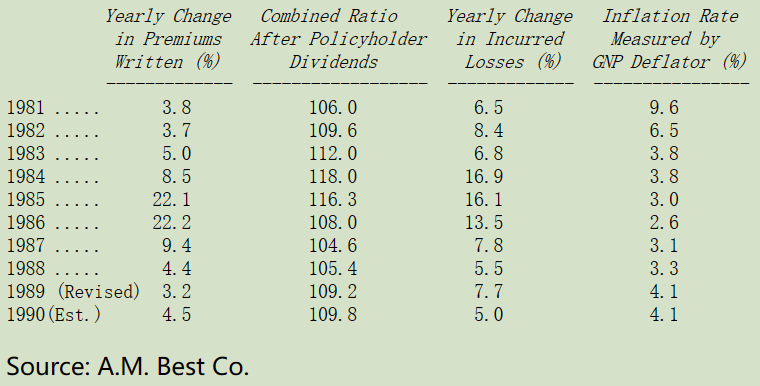

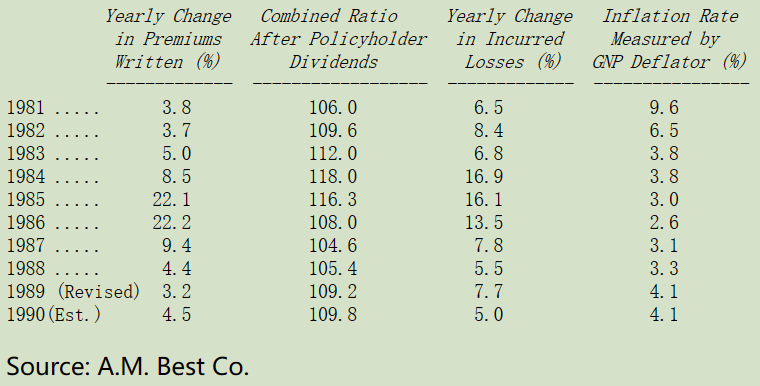

下表是财产意外险业的最新的几项重要指数:

综合比率代表的是保险的总成本(损失加上费用)占保费收入的比率,100 以下代表会有承保收益,100 以上代表会有承保亏损,比率越高,年份越差。若把持有保费收入浮存金(扣除股东权益部分所产生的收益)所产生的投资收益列入考量,损益两平的范围大概是在 107-111 之间。

基于前几次年报所说明的理由,即使是通货膨胀在这几年来相对温和,我们预期保险业每年损失增加的比率约在 10%左右,若是保费收入增长没有到达 10%以上,损失一定会增加,(事实上过去 25 年以来,理赔损失系以11%的速度在增长),虽然保险公司在景气不好时,会习惯性地将损失暂时隐藏起来,这种倾向可能会在一段时间内掩盖恶化的程度。

去年保费收入的增长远低于所需的 10%要求,承保业绩可想而知会继续恶化,(不过在这张表上,1990 年恶化的程度因为 1989 年发生 Hugo 飓风巨额损失而被略微掩盖),1991 年的综合比率将会再度恶化,有可能会增加 2 个百分点以上。

只有当大多数保险业者变得恐惧,以至于虽然现在保费价格更高,但依然想要退出时,营运结果才可能好转。就某种程度而言,这些经理人应该已经明白:当你发现自己深陷洞中最重要的一件事就是不要再挖了。不过这个临界点显然还没到,许多保险公司虽然不甘愿但还是用力地在挖洞。

还好这种情况可能在发生重大的天然灾害或金融风暴后很快地改变,但若是没有这类事件发生,可能还要再等两年,直到所有的保险公司受不了巨额的承保损失,才有可能迫使经理人大幅提高保费,而等那个时刻到来时,伯克希尔一定会作好准备,不论是在财务上或是心理上,等着接下大笔大笔的保单。

在此同时,我们的保费收入虽然很少但还是处于可以接受的范围,在下一段报告中我会告诉大家如何去衡量保险公司的绩效表现,看完之后你就会明了,为何我对我们的保险业务经理人,包含 Mike Goldberg 与他的明星团队的表现会如此满意。

在衡量我们保险业务未来几年的经营绩效时,大家应该了解,我们正在追求的生意形态可能会造成经营结果的异常波动。若是这类型的生意扩大,事实上这很有可能,则我们的承保结果可能会与一般产业趋势有很大的差异,大部分的时候,我们的成绩会超乎大家的预期,但很有可能在某一年度又大幅落后在产业标准之下。

我预估的波动主要是反映了这样一个事实,我们即将成为针对诸如飓风、风暴或是地震等真正超级大灾难(又称霹雳猫)的保险承保人,这类保单的购买者大多是接受直接保险业者分散风险的再保公司,由于他们自己本身也要分散或是卸下部分单一重要灾害的风险,而由于这些保险公司主要是希望在发生若干重大的意外后,在一片混乱之中还能有可以依靠的对象,所以在选择投保对象时,最重要的就是财务实力,而这正是我们最主要的竞争优势,在这项业务中,我们坚强的财务实力是无与伦比的。

典型的霹雳猫合约相当的复杂,不过以一个最简单的例子来说,我们可能签下一年期,保额 1,000 万美元的保单,其中规定再保公司在灾害造成了以下两种状况下才有可能得到理赔:(1)再保公司的损失超过一定的门槛(2)整个保险业界的总损失超过一定的门槛,比如是 50 亿美元。只是通常在第二种条件符合时,第一个条件也会达到标准。

对于这份 1,000 万的保单,我们收取的保费可能会在 300 万左右,假设我们一年收到所有的霹雳猫保费收入为 1 亿美元,则有可能某些年度我们可以认列将近 1 亿美元的收益,但也有可能在单一年度要认列 2 亿美元的损失,值得注意的是我们不像其它保险公司是在分散风险,相反地我们是将风险集中,因此在这一部分,我们的综合比率不像一般业者会介于 100-120 之间,而是有可能会介于 0-300 之间。

当然大多数业者在经济上无法承受这样大幅的变动,而且就算有能力可以做到,他们的意愿也不会太高。他们很可能在吃下一大笔保单之后,因为灾害发生时必须承担大额的损失而被吓跑,此外大部分的企业管理层会认为他们背后的股东应该不喜欢变动太大。

不过我们采取的策略就不同了,我们在直接产险市场的业务相当少,但我们相信伯克希尔的股东,若事先经过沟通,应该可以接受这种获利波动较大,只要最后长期的结果能够令人满意就可以的经营结果,(查理跟我总是喜欢变动的 15%更胜于固定的 12%)。

我们有三点必须要强调:(1)我们预期霹雳猫的业务长期来讲,假设以 10 年为期,应该可以获得令人满意的结果,当然我们也知道在这其中的某些年度成绩可能会很惨,(2)我们这样的预期只能基于主观的判断,对于这样的保险业务,历史的资料对于我们在做定价决策时并没有太大的参考价值,(3)虽然我们准备签下大量的霹雳猫保单,但有一个很重要的前提那就是价格必须要能够与所承担的风险相当,所以若我们的竞争对手变得乐观积极,那么我们的承保量就会马上减少,事实上过去几年市场价格有点低的离谱,这使得大部分的参与者都被用担架抬着离场。

在此同时,我们相信伯克希尔将会成为全美最大的再保险承保公司,所以要是那天大都会地区发生大地震或是发生席卷欧陆地区的风暴时,请点亮蜡烛为我们祈祷。

〔译文源于芒格书院整理的巴菲特致股东的信〕