巴菲特致股东的信(1990年)

⑥衡量保险业的表现

衡量保险业的表现

在前段文章我曾提到浮存金,也就是保险业者在从事业务时,所暂时持有的投保人的资金,因为这些资金可以用在投资之上,所以财产意外险公司可承受超过保费收入 7%到 11%的损失与费用,并且仍能在业务上达到损益两平,当然这要扣除保险业者本身的净值,也就是股东自有资金所产生的获利。

当然 7-11%的范围还是有许多例外情况,例如保险业者承保谷物冰雹伤害损失几乎没有浮存金的贡献,保险业者通常是在冰雹即将来临之前才收到保费收入,而只要其中有任何一位农夫发生损失就要马上支付赔偿金,因此即使谷物冰雹保险的综合比率为 100,保险业者也赚不了半毛钱。

另外一个极端的例子,涵盖了医师、律师与会计师的潜在责任事故保险,较之每年收到的保费收入,该险种的浮存金就很高,这种浮存金之所以很重要的原因在于理赔申请案通常会在业务过失发生很长一段时间之后才会提出,而且由于冗长的法律诉讼程序,真正的理赔支付会进一步拖迟,保险业界统称医疗事故保险与其它特定种类的责任保险为“长尾业务”,意思是说保险业者在将理赔金支付给申请人跟他的律师(或甚至是保险公司的律师)之前,可以持有这一大笔的资金相当长的一段时间。

像这种长尾业务,通常即使综合比率高达 115(或更高)都还可能有获利,因为在索赔与费用发生之前的那一段时间利用浮存金所赚的利润甚至会超过 15%。然而重点是,所谓的长尾确切含义是:最初假设为 115%的综合比率的责任险业务,但结果却尾大不掉,经过多年的纠缠终于和解,最终 200、300 或是更糟的综合比率压垮了保险公司。

这项业务一定要特别注意一项时常令人忽略的经营原则的陷阱:虽然部分长尾业务在 110-115 的综合比率之间仍可以获利,但若是保险业者依此比率作为目标来设定保费价格的话很可能会亏大钱,所以保费价格必须要有一个安全的边际空间,以防止当今总是会让保险业有昂贵的意外成本蹦出来的社会趋势,将综合比率设在 100%一定会产生重大的损失,将目标锁定在 110-115 之间则无异是自杀的行为。

说了那么多,到底该如何衡量一家保险公司的获利能力呢?分析师与经理人通常习惯性的会去看综合比率,当然在我们要看一家保险公司是否赚钱时,这项比率是一个很好的指标,但我们认为还有一项数字是更好的衡量标准,那就是承保损失与浮存金规模的比率。

这种承保损失/浮存金比率跟其它保险业常用的绩效衡量统计数字一样,必须要有一段相当长的时间才有意义,单季或甚至是单一年度的数字,会因为估计的成份太浓而无参考价值,但是只要时间一拉长,这个比率就可以告诉我们保险营运所产生浮存金的资金成本,若资金成本低就代表这是一家好公司,相反地就是一家烂公司。

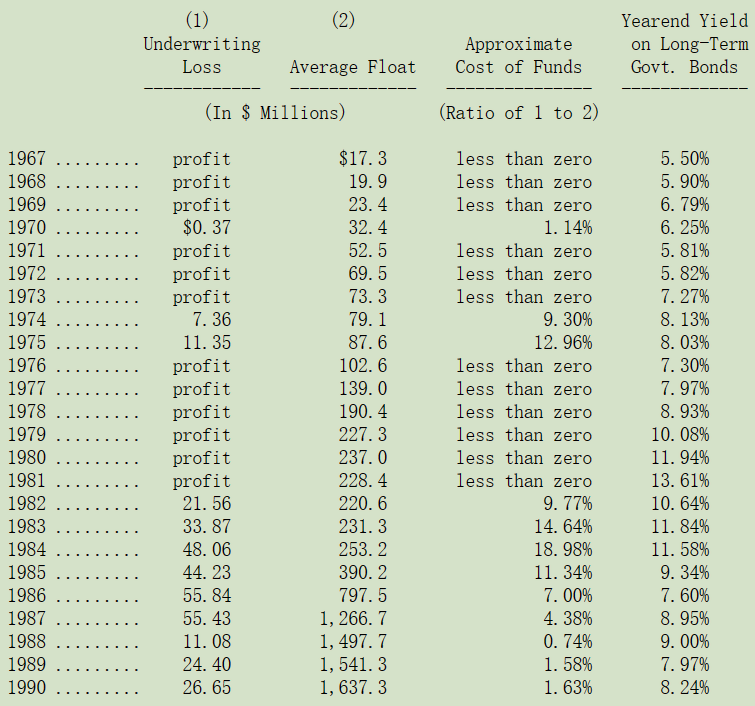

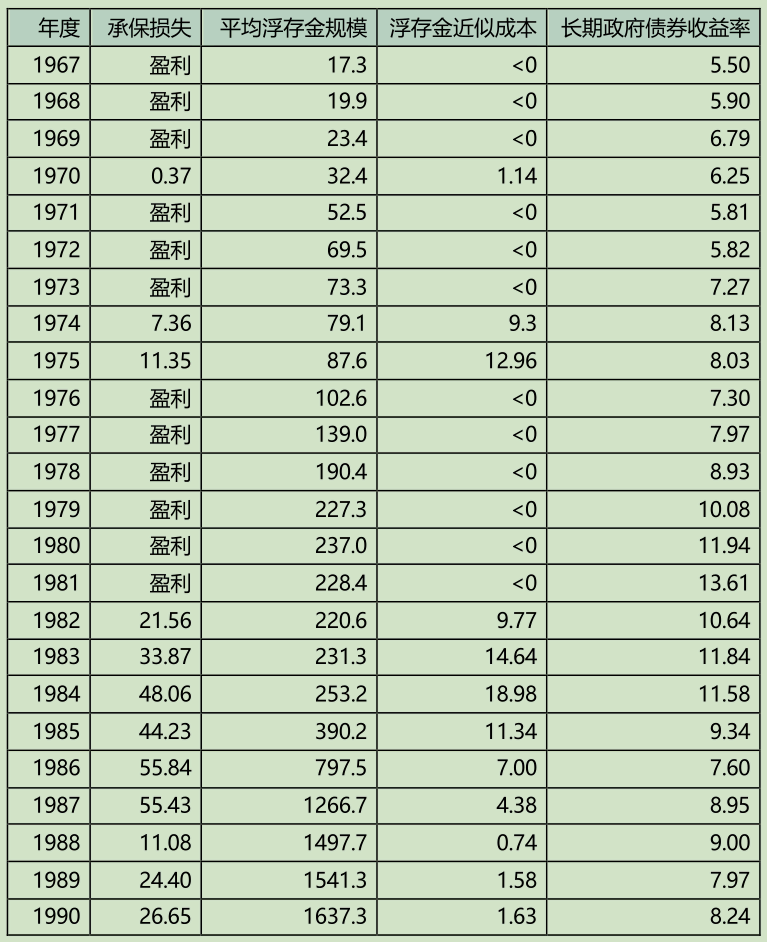

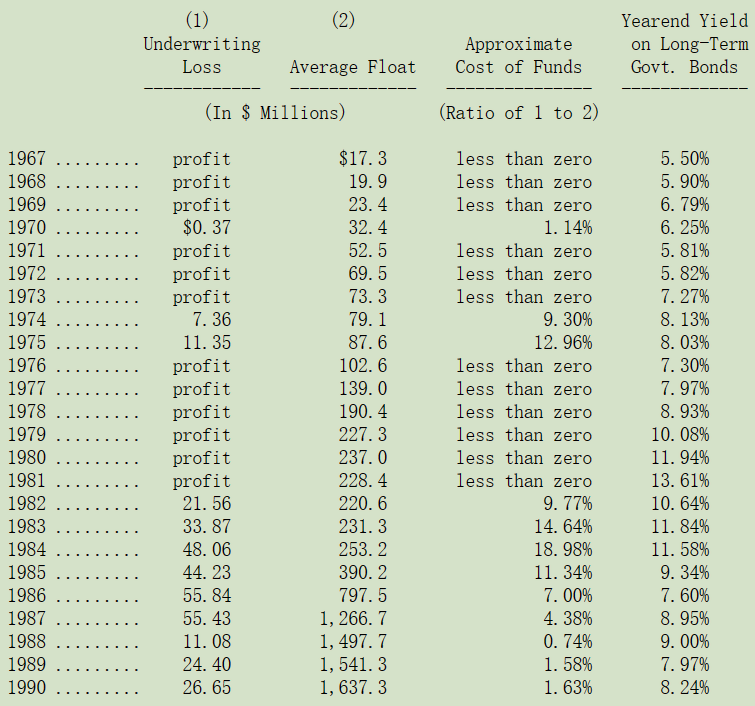

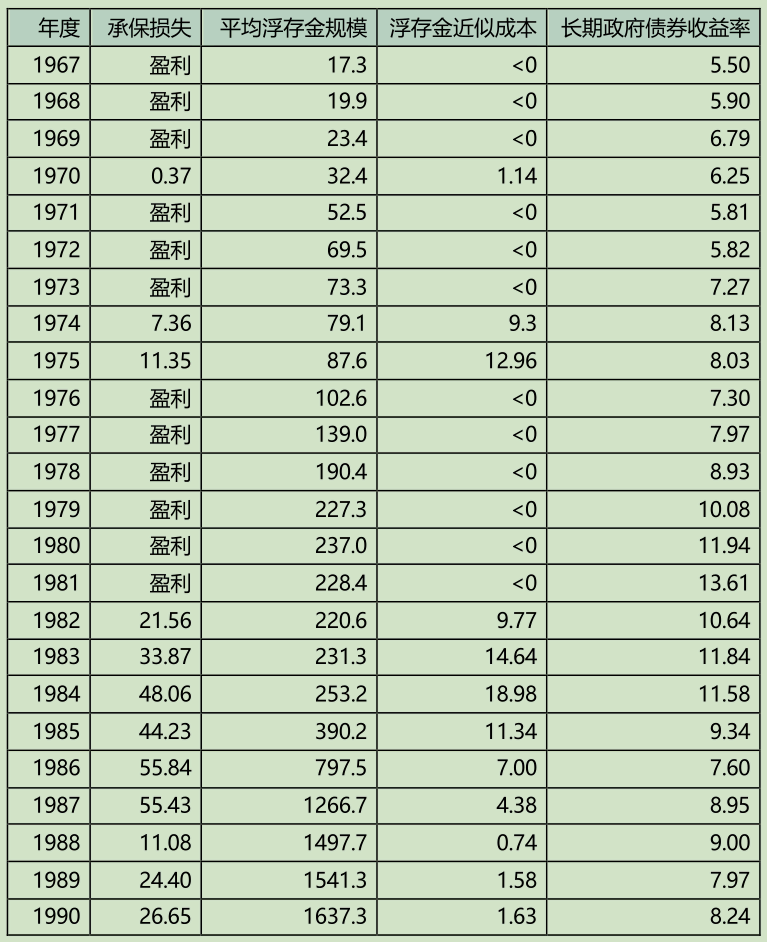

下表是我们进入保险业后,每年的承保损失统计(若有的话),以及每年平均持有的浮存金数量,从这个表我们可以很轻易地算出保险业务所产生的浮存金其资金成本是多少。

浮存金的数字是将所有的损失准备金、损失调整费用准备金与未赚取保费准备金加总后,再扣除应付代理人佣金、预付购置成本及相关再保递延费用,若是别的保险业者可能还有其它项目需要列入做计算,但因为这些科目在伯克希尔并不重要,所以予以省略。

在 1990 年我们大概持有 16 亿美元的浮存金,这些钱会慢慢地流到其它人的手中,当年度的承保损失约为2,600 万美元,因此我们从保险营运所获得的资金,其成本约为 1.6%,而就如同这张表所显示的,有些年度我们有承保获利,所以我们的资金成本甚至低于零,但是也有些年度,像 1984 年我们必须为浮存金支付相当高的成本,但是总计至今 24 个年度当中有 19 个年度,我们负担的资金成本甚至比美国政府发行债券的成本还低。

这项计算式有两个重要的要求,首先,胖女人还没有喝水润嗓,更别说开口唱歌了,除非等到这时间所发生的损失都已确定解决,否则我们不能确定 1967-1990 年的资金成本到底是多少。第二,浮存金对于股东的价值有点打折,因为股东们还必须投入相对应的资金来支持保险业务的营运,同时这些资金所赚取的投资收益又必须面临双重的课税,相比之下,股东资金拿去直接投资更具税收效率。

间接投资加诸在股东身上的租税惩罚事实上是相当重的,虽然计算公式铁定没办法做的很精确,但我估计,对于这些保险业务的股东来说,租税惩罚至少让他们增加一个百分点以上的资金成本,我想这个数字也适用于伯克希尔之上。

分析保险业务的资金成本使得任何人都可以据此判断这家公司的营运对于股东到底是正面的还是负面的,若是这项成本(包含租税惩罚)高于其它替代性的资金来源,其价值就是负的,若是成本更低,那么对股东便能产生正面的价值,而若是成本远低于一般水准,那么这个业务就是一项相当有价值的资产。

到目前为止,伯克希尔算是资金成本相当低的那类,我们拥有 48%股权的 GEICO 保险的这项比率更好,且通常每年都保持承保盈利,GEICO 藉由不断地成长提供越来越多的资金以供投资,而且它的资金成本还远低于零成本以下,意思是说,GEICO 的保单持有人不但要先付保费给公司而且还要支付利息,就像有人又帅又有才干一样,GEICO 非凡的获利能力来自于高效运营与对风险的严格分类,同时使得保户也可享受超低价格的保单。

在另外一方面,许多知名的保险公司,在考量承保损失/浮存金的成本,再加上税收惩罚之后,事实上让股东产生负的回报,此外这些公司像其它业者一样,相当容易受到大型灾害的伤害,在扣除再保部分所得到的保护之后,资金成本有可能升高到无以复加的地步,而除非这些公司能够大幅改善其承保的成绩,历史的经验显示这是项不可能的任务,这些股东很可能会和类似银行股东一样的下场:吸收存款的利息支出高于发放贷款的利息收入。

总的来说,保险营运给我们的回报算是相当不错的了,我们的保险浮存金以合理的资金成本率持续增加,而靠着这些低成本的资金赚取更高的投资报酬使我们的事业蒸蒸日上,确实我们的股东必须负担额外的税负,但大家从这样低的资金成本所获得的收益却更多(至少到目前为止是如此)。

尤其令人振奋的一点是,这些记录还包含本人之前所犯下一些重大的错误,在 Mike Goldberg 接手后,应该会有更好的成绩,保险往往会有一大堆让你犯错误的机会,而通常在这些机会敲门时,我都会响应,以致于经过那么多年之后,到现在我们还必须为我以前所犯的错误付出代价,在保险业中,愚蠢行为是没有上限的。

我们保险业务的实际价值永远比其它业务如糖果或是报纸业务难以估计,但是不管用任何计算方法,保险业务的价值一定远高于其帐面价值,更重要的是虽然保险业让我们三不五时会出状况,但这行业却是我们现在所有不错的业务当中,最有成长潜力的。

〔译文源于芒格书院整理的巴菲特致股东的信〕