巴菲特致股东的信(1990年)

⑦有价证券

有价证券

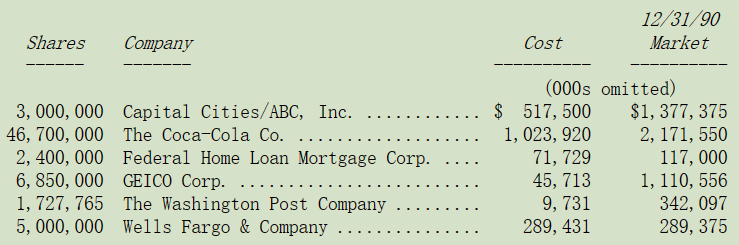

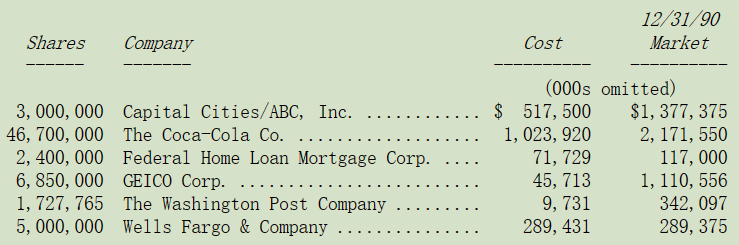

下表是我们超过一亿美元以上的普通股投资,一部分的投资系属于伯克希尔拥有不到 100%的投资。

树懒(Folivora)天生特有的懒散正代表着我们的投资模式,今年 6 只主要持股中的 5 只,我们没有增加也没有减持。除了富国银行这家拥有良好的经营团队,并享有相当高的股本回报率的银行,所以我们将持股比率增加到10%左右,这是未经美联储批准所能持有的最高上限,其中六分之一是在 1989 年买进,剩下的部分则是在 1990年增加。

银行业并不是我们的最爱,因为这个行业的特性是资产约为股本的 20 倍,这代表只要资产发生一点问题就有可能把股本亏光光,而偏偏大银行出问题早已变成是常态而非特例,许多情况是管理层的疏失,就像是去年度我们曾提到的制度迫力,也就是管理层会不自主的模仿其它同业的做法,不管这些行为有多愚蠢,在从事放款业务时,许多银行业者也都有旅鼠那种追随领导者的行为倾向,所以现在他们也必须承担像旅鼠一样的命运。

因为 20:1 的高杠杆比率,使得管理的优势与缺点都会被放大,我们对于用便宜的价格买下经营不善的银行一点兴趣都没有,相反地我们希望能够以合理的价格买进一些经营良好的银行。

在富国银行,我想我们找到银行界最好的经理人卡尔·理查德(Carl Reichardt)与保罗·亚曾(Paul Hazen),在许多方面这两个人的组合使我联想到另外一对搭档,那就是大都会/ABC 的汤姆·墨菲与丹·伯克(Dan Burke),首先,两个人 1+1 的效果都大于 2,因为每个人都了解、信任并尊敬对方。其次,他们对于有才能的人给予高薪,但也同时厌恶冗员过多。第三,尽管公司获利再好,他们控制成本的努力不曾缩减,最后,两者都坚持自己所熟悉的领域,让他们的能力而非自尊来决定成败,就像 IBM 的 Thomas Watson 曾说:“我不是天才,我只是有点小聪明,不过我就呆在这几点周围。”

我们是在 1990 年银行股一片混乱之间买进富国银行的股份的,这种失序的现象是很合理的,几个月来有些原本经营名声不错的银行,其愚蠢的贷款决定却一一被媒体揭露,随着一次又一次巨大的损失数字被公布,银行业的诚信与保证也一次又一次地被践踏,渐渐地投资人越来越不敢相信银行的财务报表数字。趁着大家出脱银行股之际,我们却逆势以 2.9 亿美元买进富国银行 10%的股份,市盈率不到税后收益五倍,税前收益三倍。

富国银行实在是相当的大,帐面资产高达 560 亿美元,股本回报率 ROE 高达 20%,资产回报率 ROA 则为1.25%,买下他 10%的股权相当于以买下一家 50 亿美元资产 100%股权,但是真要有这样条件的银行,其价码可能会是 2.9 亿美元的一倍以上,此外就算真的可以买得到,我们同样也要面临另外一个问题,那就是找不到像卡尔·理查德这样的人才来经营,近几年来,从富国银行出来的经理人一直广受各家银行同业所欢迎,但想要请到这家银行的老宗师可就不是一件容易的事了。

当然拥有一家银行的股权,或是其它企业也一样,绝非没有风险,像加州的银行就因为位于地震带而必须承担客户受到大地震影响而还不出借款的风险,第二个风险是属于系统性的,也就是严重的经济萧条或是财务风暴导致这些高杠杆经营的金融机构,不管经营的多么好都有相当的危机。最后,市场当时主要的考虑点是美国西岸的房地产因为供给过多而崩盘的风险,连带使得融资给这些扩建案的银行承担巨额的损失,而由于富国银行是市场上最大的不动产贷款机构,因此被认为特别脆弱。

以上所提到的风险都很难加以排除,当然第一点与第二点的可能性相当低,而且即使是房地产大幅的下跌,对于经营绩效良好的银行也不致造成太大的问题,我们可以简单地算一下,富国银行现在一年在提列 3 亿美元的损失准备之后,税前还可以赚 10 亿美元以上,今天假若该银行所有的 480 亿借款中有 10%在 1991 年发生问题,且估计其中有 30%的本金将收不回来,必须全部列为损失(包含收不回来的利息),则在这种情况下,这家银行大致可以损益两平。

若是真有一年如此,虽然我们认为这种情况发生的可能性相当低,我们应该还可以忍受,事实上在伯克希尔选择并购或是投资一家公司,头一年不赚钱没有关系,只要以后每年能够有 20%的股本回报率,尽管如此,加州大地震使得投资人害怕新英格兰地区也会有同样的危险,导致富国银行在 1990 年几个月间大跌 50%以上,虽然在股价下跌前我们已买进一些股份,但股价下跌使我们可以开心地用更低的价格捡到更多的股份。

以长期投资作为终生目标的投资人对于股市波动也应该采取同样的态度,千万不要因为股市涨就欣喜若狂,股市跌就如丧考妣。奇怪的是他们对于食物的价格就一点都不会搞错,很清楚知道自己每天一定会买食物,当食物价格下跌时,他们可高兴的很,要烦恼的应该是卖食物的人。同样的在布法罗报纸我们期望新闻纸能够降低,虽然这代表我们必须将帐列的新闻纸存货价值向下调整,因为我们很清楚,我们必须一直买进这些产品。

同样的原则也适用在伯克希尔的投资之上,只要我还健在(若我死后,伯克希尔的董事会愿意通过我所安排的降神来接受我的指示,则持续的时间或许更长久),我们会年复一年买下整个企业或是企业的部分股票,也因此股票价格的下跌对我们会更有利,反之则可能会对我们不利。

股价不振最主要的原因是悲观的情绪,有时是整个市场,有时则仅限于部分行业或公司,我们很期望能够在这种环境下做生意,不是因为我们天生喜欢悲观,而是如此可以得到便宜的价格买进更多好的公司,乐观主义是理性投资人最大的敌人。

当然,以上所述并不代表不受市场欢迎或注意的股票或企业就是好的投资标的,反向操作有可能与从众心理一样的愚蠢,真正重要的是独立思考而不是投票表决,不幸的是伯特兰·罗素(Bertrand Russell)对于人性的观察同样地也适用于财务投资之上,“大多数的人宁死也不愿意去思考!”。

* * * * * * * * * * * *

我们去年其它主要的投资组合的变动就是增加 RJR Nabisco 的债券,我们是在 1989 年开始买进这种有价证券,到了 1990 年底我们的投资金额约为 4.4 亿美元,与目前的市价相当(不过在撰写年报的同时,他们的市价已增加了 1.5 亿美元)。

就像我们很少买进银行股,同样地我们也很少买进投资等级以下的债券,不过能够引起我们兴趣的投资机会,同时规模大到足以对伯克希尔有相当影响力的投资机会实在是不多,因此我们愿意尝试各种不同的投资工具,只要我们对于即将买进的投资标的有相当的了解,同时价格与价值有相当大的差距。伍迪艾伦有一句台词用来形容开明的好处︰“我实在不理解为什么有那么多人排斥双性恋,因为这会让人们在周六晚上约会的机会翻倍”。

在过去我们也曾成功地投资了好几次投资等级以下的债券,虽然他们多是传统上所谓的失翼的天使,意思是指:发行时属于投资级,但后来因为公司陷入困境而被降级。在 1984 年的年报中我们也曾经提到过买进华盛顿公用电力系统债券的原因。

不过到了 1980 年代大量假冒的失翼的天使充斥着整个投资界,也就是所谓的垃圾债券,这些债券在发行时企业本身的信用评级就不佳,十年以来,人为制造的垃圾债券变得越来越垃圾,最后真的变成名符其实的垃圾。到了 1990 年,在经济衰退引发债权危机之前,整个投资界的天空已布满着这些假冒失翼天使的尸体。

迷信这些债券的门徒一再强调不可能发生崩盘的危机,巨额的债务会迫使公司经理人更专注于经营,就像是方向盘上绑着匕首的驾驶员一定会小心翼翼地开车一样。当然,我们绝对相信,这样一个引人注目的装置一定会让驾驶员相当小心谨慎,但另一个确定的后果是,如果车子碰到哪怕最小的一个小坑或是冰片,就可能造成致命的后果。而偏偏在商业的道路上,遍布着各种坑坑洞洞,一个要求必须避开所有坑洞的计划实在是一个相当危险的计划。

在《聪明的投资者》最后一章中,格雷厄姆很强烈地驳斥这种匕首理论,如果要将稳健的投资浓缩成四字箴言,那就是安全边际,在读到这篇文章的 42 年后,我仍深深相信这四个字,没能注意到这个简单原则的投资人在1990 年一开始就尝到损失的痛苦。

在债务狂潮的鼎盛时期,煞费苦心设计的资本结构注定导致失败的发生:有些公司的融资杠杆高到即使是再好的企业也无法负担。几年前,有一个特别惨、一出生就夭折的案例,就是一个坦帕湾地方电视台的并购案,收购时借了太多的债,以至于一年的利息负担甚至超过他一整年的收入,也就是说即使所有的人工、节目与服务都不算成本,且营收也能有爆炸性的成长,这家电视台还是会步上倒闭的命运。许多为这次收购提供资金的债券都是由现在大多倒闭的储贷机构买进,所以身为纳税义务人的你,等于间接替这些愚蠢的行为买单。

现在看起来这种情况当然不太可能再发生。当这些错误的行为发生时,专门贩卖匕首的投资银行家纷纷把责任推给学术单位,表示研究报告称,低等级债券所收到的利息收入足以弥补投资人所承担可能收不回本金的风险。因此,好心的业务员表示,多元化的垃圾债券组合将给客户带来比高等级债券更好的收益。特别要小心财务学上过去的统计资料实证,若历史资料是致富之钥,那么福布斯 400 大富豪不都应该是图书馆员吗?

不过这些业务员的逻辑有一个漏洞,这是统计系的新生都知道的。人们假设,所有新发行的垃圾债券都与以前的低等级失翼天使债券完全一样。因此,后者的违约经验对于预测新发行债券的违约经验具有重要意义。这种错误就像是在喝琼斯镇被投毒的酷爱饮料之前,以该饮料过去的死亡率为参考(1978 年琼斯镇惨案)。

两者在许多方面有很大的不同,对于开拓者来说,失翼天使的经理人无不渴望重新到投资等级的名单之上,但是垃圾债券的经营者就全然不是那么一回事了,他们表现得像一个吸食海洛因的人,把精力投入到了寻找另一种治疗方法上,不思解决其为债务所苦的困境。此外,失翼天使高管信托的敏感特质通常比那些垃圾债券经营者要来的好的多。

华尔街对于这样的差异根本就不在乎,通常华尔街关心的不是它到底有多少优缺点,而是它可以产生多少收入。成千上万的垃圾债券,就是由这帮满不在乎的银行家,卖给那些不懂得思考的投资人,这两种人遍地都是。

即使现在垃圾债券的市场价格只剩发行价格的一点点,它仍是个地雷区。就像是去年我们曾经说过的,我们从来不买新发行的垃圾债券,不过趁现在市场一遍混乱,我们倒是愿意花点时间看看。

在 RJR Nabisco 这个案子我们认为这家公司的债信等级要比外界想象中好一点,同时我们感觉潜在的收益,应该可以弥补我们要承担的风险(虽然绝非无风险),RJR 资产处份的价格还算不错,股东权益增加了许多,现在经营也渐上轨道了。

然而在我们调查垃圾债后发现,大部分低等级的债券还是不具吸引力, 1980 年代华尔街的工作比我们想象中更糟糕,许多重要企业都大受影响,不过我们还是会继续在垃圾债券市场中寻找好的投资机会。

〔译文源于芒格书院整理的巴菲特致股东的信〕