巴菲特致股东的信(1993年)

⑥保险业务营运

保险业务营运

接下来到这里,我们通常会准备一张表,用来说明过去十多年来保险业的综合比率,综合比率代表保险的总成本(理赔损失+运营费用)占保费收入的比例,多年以来,比率在 100 以上代表承保亏损,也就是说,保险业者当年度从客户那里收到的保费,不足以支应必须支付给保户的理赔款以及营运所需的费用开支。

有一个高兴的事实,能够抵消这些亏空:保险业者在真正支付给客户理赔金之前,通常有一段时间可以将这笔钱好好地运用,因为大部分的保单都是先向客户收取保费,更重要的是,通常得花上一段时间才会将损失理赔款给付出去,尤其是像产品责任险或是渎职险,通常要花上好几年才能将理赔损失定案。

再讲白一点,这些保户预付的保险费,加上那些已经发生但还未理赔的资金,统称为保险浮存金,在过去,利用这些浮存金创造投资收益,使得整个保险业即使综合比率高达 107-111 依然可以维持损益两平。

不过随着利率下滑,保险浮存金的价值大幅滑落,因此过去我们提供的比率已经无法用来衡量保险业者每年的盈利状况,比起 1980 年代,今天一家拥有相同综合比率的保险公司已逊色很多。

我们认为,只有将保险业的承保结果与保险浮存金可以获得的无风险收益一同分析,才能正确地评估一家财产意外险公司真正的价值,当然一家保险公司利用其浮存金与股东资本金所能创造的投资收益也相当重要,这点也是投资人在评估该公司的经营业绩时,必须特别注意的,只不过那是另外一个主题。保险浮存金的价值,关键在于其从保险业务转至投资业务时的转换成本,这点可以简单的以长期无风险的资金利率作为标准。

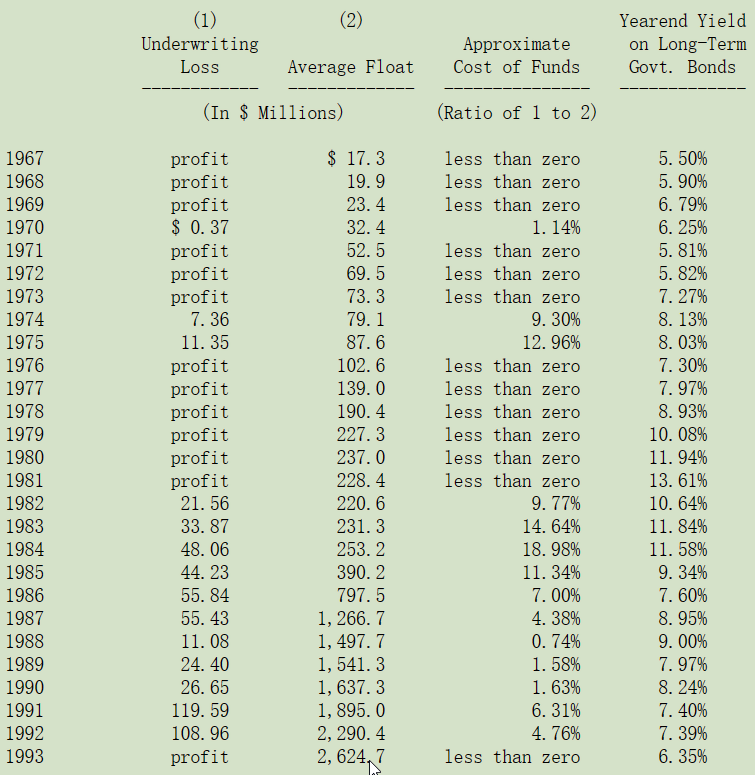

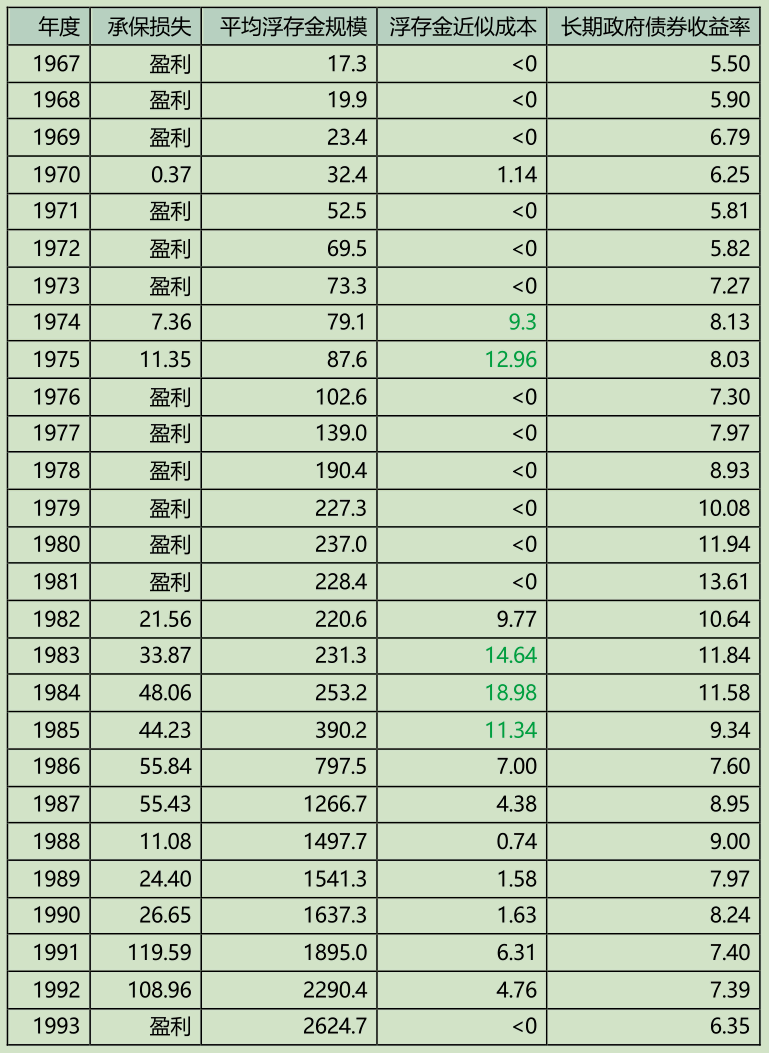

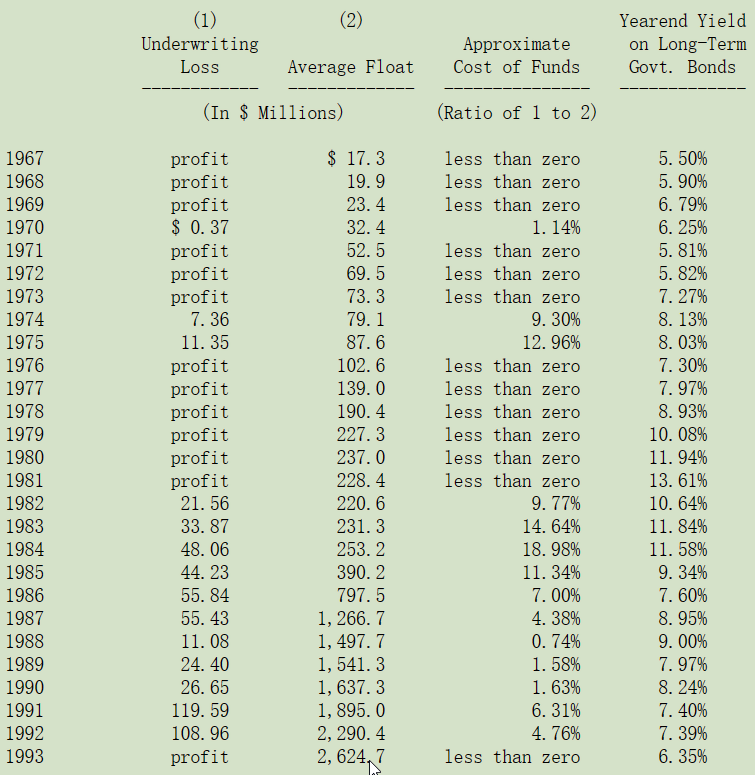

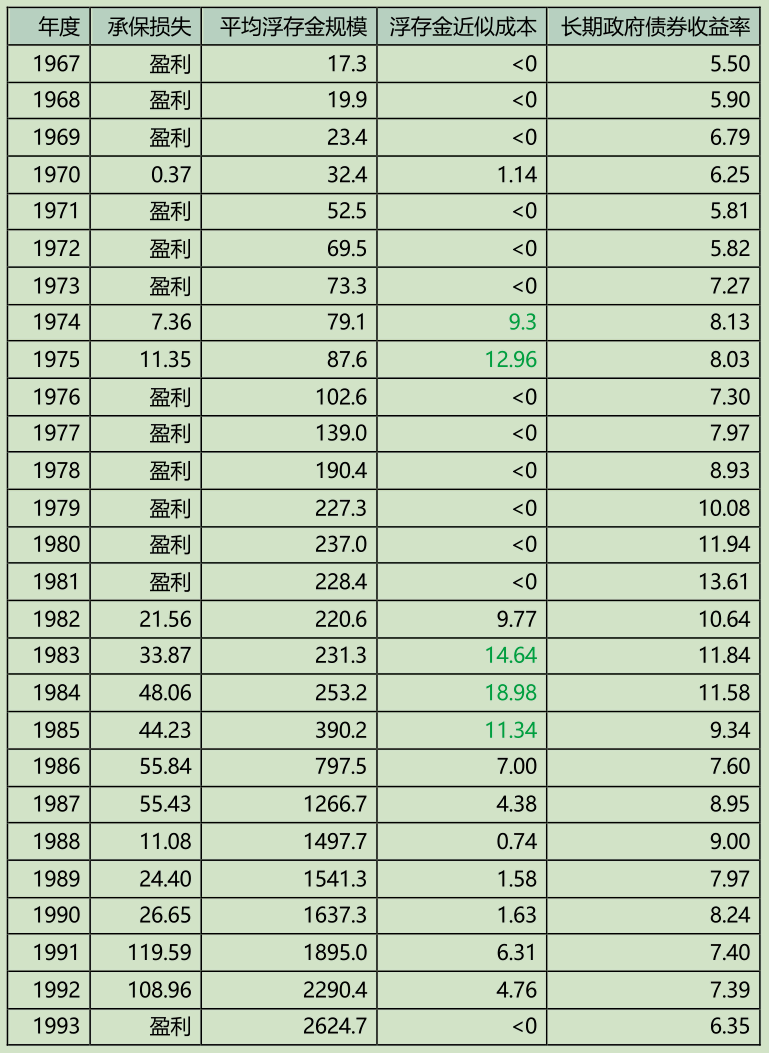

下面我们将会列出评估伯克希尔保险业务价值的重要数字。首先,先计算浮存金总额(相对于我们的保费收入总额,我们的浮存金规模算是相当大的),先将所有的损失准备金、损失费用调整准备金与未赚保费准备金加总求和,再减去应付佣金,预付并购成本,以及相关再保递延费用。浮存金的成本取决于所发生的承保损益,在那些有承保利润的年份,包括 1993 年,我们浮存金的成本甚至是负的。承保损益加上浮存金获取的收益,就是我们保险业务的收益。

大家应该看得出,去年我们保险业务的运营结果,等于是让我们可以免费使用 26 亿美元的浮存金,另外还赚了 3,100 万美元的承保利润,这看起来相当不错,但实际情况并没有那么好。

我们试着冷静一下,因为我们承保了大量的巨灾再保险保单(super-cat 超级猫是其它保险公司或再保公司专门买来分担他们在发生重大意外灾害时,所可能造成的损失),同时,去年这类的业务并没有出现重大的损失,也就是说,就连发生在 1993 年真正严重的中西部水灾也没有触及巨灾险损失理赔的门槛,原因是很少有私营保险公司会去购买水灾险。

这样很容易会产生错觉,认为单一年度巨灾险的成绩是相当不错且令人满意的一年,一个简单的例子足以说明一切,假设一个重大的意外事件每百年平均都会发生 25 次,而你每年都以一赔五的赔率赌它当年不会发生,则你赌对的年份可能远比赌错的年份多出许多,甚至你有可能连续赌对六年、七年,或是更多年,但事实上不管怎样,最后你一定会以破产作为结局。

在伯克希尔,我们直觉地相信我们已经收到了合理的保费,约以一赔 3.5 的赔率接受赌注,当然没有人可以真正正确地算出巨灾再保险真正的赔率,事实上,可能要等到几十年后,我们才能知道当初的判断是否正确。

不过我们确实知道,当损失真正降临时,铁定是件轰动的事,可能会发生三倍或四倍于我们在 1993 年所赚到的收益那样大的意外事件,1992 年 Andrew 飓风发生的那次,我们总共赔了 1.25 亿美元,时至今日由于我们已大幅扩大在巨灾险的业务量,所以同样规模的飓风可能会造成我们 6 亿美元左右的理赔损失。

1994 年到目前为止,我们还算是幸运,在我写这封信时,我们因为洛杉矶大地震所造成的损失还算在正常范围之内,不过要是当时地震发生的规模不是 6.8 而是 7.5 的话,那么最后的结果就另当别论的。

伯克希尔本身很适合从事巨灾险业务,我们有业界最优秀的经理人阿吉特·贾恩(Ajit Jain),此外从事这行需要相当雄厚的资金实力,在这点上,我们公司的账面价值大概是其他主要竞争对手的 10-20 倍,就大部分的保险业务而言,背后所拥有的雄厚资源还不是那么地重要,一家保险公司可以很轻易地就把它所承担的风险分散出去,若有必要,也可以降低险种集中度以减低风险,但是对巨灾险这种特殊的保险就没有办法这样子做,所以其它的竞争同业只能被迫降低理赔的上限来应对,而要是他们激进点胆敢承担更高的风险,则一个超大型的意外灾害或是连续发生几个较小型的灾害,就有可能让他们粉身碎骨。

有一件事情可以显示我们超强的竞争力与卓越的声誉,那就是全世界前四大再保险公司全部都在伯克希尔投保巨额的巨灾险,这些大公司比谁都清楚,对于再保险来说,真正要考验的是他们在困难的状况下,愿意且能够支付理赔金的能力与意愿,而绝对不是在太平时期,勇于接受保费收入的意愿。

值得注意的是,近年来愿意接受再保险业务的供给量大幅增加,再保业者总共募集了近 50 亿美元的资金来进军这类业务,且大部分都是新成立的公司,很自然的这些新进的业者急欲承接业务,以证明当初他们吸收资金时所作的业绩预测,这些新加入的竞争并不会影响我们 1994 年的营运,因为我们早已经接满了生意,主要是在1993 年签下的,不过我们已经看到保费价格有恶化的趋势,如果这种情况持续下去,我们将会大幅降低承接的业务量,但随时准备好为大型且复杂的保险业者服务,他们需要实力雄厚且有能力支付理赔损失的巨灾险承保人。

在我们其它保险业务方面,Rod Eldred 领导的住宅保险业务、Brad Kinstler 领导的工伤赔偿保险业务,Kizer 家族经营的信用卡保险业务,以及 Don Kinstler 所领导的国民保险所从事的传统汽车保险与一般责任险方面,总的来说,这四类业务都表现的相当不错,不但有承保利润,还贡献了相当大金额的保险浮存金。

总而言之,我们拥有第一流的保险业务,虽然他们的经营成果变化相当的大,但是其内在价值却远超过其帐面的价值,而事实上,在伯克希尔其它事业的身上也有类似的情况。

〔译文源于芒格书院整理的巴菲特致股东的信〕