巴菲特致股东的信(1994年)

②帐面价值与内在价值

帐面价值与内在价值

我们会定期报告每股的帐面价值,虽然它的用处不大,但这总算是一个比较容易计算的数字。我们一再提醒各位,真正重要的是内在价值,这是一个无法精确计算但必须估算的数字。

例如我们可以很确定的告诉大家 1964 年每股的帐面价值是 19.46 美元,不过这个数字很明显的高于其内在价值,因为公司的所有资产主要集中于盈利能力不佳的纺织事业上,我们的纺织资产既没有持续经营价值也没有同帐面价值相等的清算价值,所以任何想要了解 1964 年伯克希尔资产负债表健全性的人士,得到的答案跟恶名昭彰的好莱坞大亨可能给你的答案一样:“放心好了,负债表如假包换!”。

如今伯克希尔的资产已完全逆转,我们许多控股企业的内在价值远远超过其帐面价值,(我们不控股的公司,如可口可乐或吉列刮胡刀则是以目前市价列示),不过我们仍继续向各位报告帐面价值的数字,因为它们是伯克希尔内在价值的一项粗略跟踪指针,尽管被低估了。事实上,去年这两项指标颇为一致:帐面价值增加了 13.9%,这也是内在价值近似收益。

我们将内在价值定义为一家企业在其剩余期间所能产生现金流量的折现值。任何计算内在价值的人都会得到一个高度主观的数字,随着未来现金流量估计的修正与利率的变动,这个数字会不断变化。虽然模糊难辨,但内在价值却是最重要的,也是评估投资标的与企业相对吸引力的「唯一合乎逻辑」的方法。

为了理解历史投入的帐面价值与未来产出的内在价值会有怎样不同的演变,让我们看看另一种投资形式:大学教育,将教育成本视为其帐面价值,再进一步,还要包含学生因上大学而放弃工作收入的机会成本。

在这里,我们暂不考虑非经济的效益而只专注于经济效益。首先,我们必须先估计这位毕业生终其一生的职场生涯所能获得的全部收入,然后再扣除要是他没有接受这项教育,原本可以得到的全部收入的估计值,从而我们可以得到因为这项教育投资,他可以获得的超额收入,然后以一个适当的利率加以折现,得到截至毕业日止的折现值,这个结果也就是这项教育投资所能够带来的内在经济价值。

有些毕业生发现,其教育成本可能远高于计算出来的内在价值,这就代表着不值得他去接受这样的教育;而另有一些是接受教育所产生的内在价值远高于投入的教育成本,那么代表他接受教育是明智的选择。显而易见的是,不管哪种情况下,账面价值作为内在价值的指标都毫无意义。

现在就让我们不那么学术,来看看伯克希尔实际投资的 ScottFetzer 当做具体的例证,在这里我们不但可以解释帐面价值与内在价值之间如何变化,同时可以藉此替大家上一课期待已久的会计学,当然这次我选择说明的对象是一个相当成功的并购投资案。

伯克希尔是在 1986 年初收购了 ScottFetzer,当时这家公司拥有 22 项不同的事业,时至今日我们没有新增,也没有出售其中任何一项,他主要的营运集中在世界百科全书、Kirby 吸尘器与 Campbell 空压机,当然其余的事业也是收入的重要组成部分。

当时我们为 1.726 亿美元的帐面价值斥资 3.152 亿美元买下他,溢价 1.426 亿美元,这代表着我们认为这家公司的内在价值大概是其帐面价值的两倍。

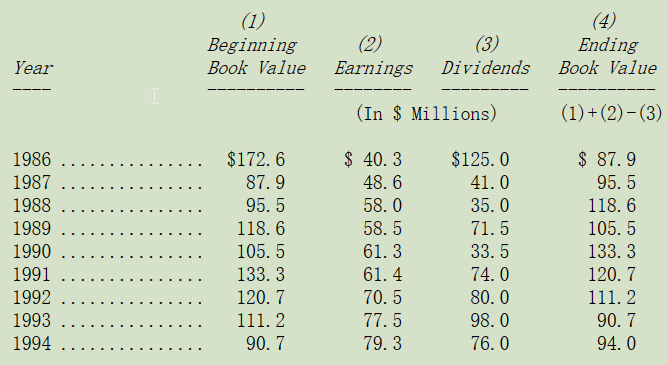

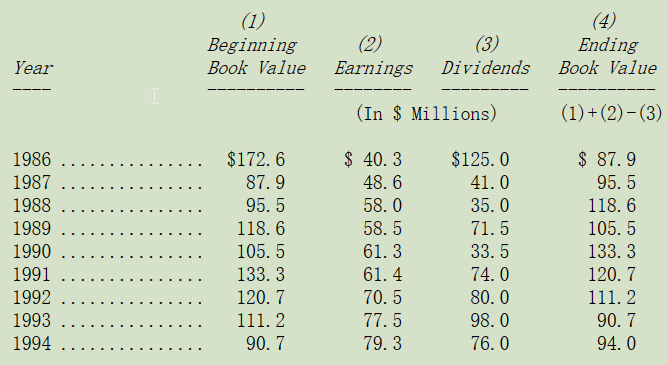

下表显示的是自我们买下 ScottFetzer 后,历年来的帐面价值以及它的利润与股息:

因为在达成交易当年,公司帐上有多余的现金,所以虽然 ScottFetzer 在 1986 年的盈利只有 4,030 万美元,但却能够支付伯克希尔 1.25 亿美元的股利。另外还有一点我必须强调的是,该公司并没有运用任何的财务杠杆,事实上,在我们并购之初公司已经从有限的负债变成几无债务(除了财务子公司的借款)。我们也没有把工厂卖掉再租回来或是出售应收帐款之类的举动,在我们买下的这几年,该公司一直以相当保守的资本经营并且维持相当高的流动性。

大家可以看到,公司的收益在我们买下之后持续稳定的增加,不过于此同时账面价值却未呈等比例的增加,也因此在我们买下该公司时,就已经有相当不错的股东权益回报率,到现在又变得更加出色。将 ScottFetzer 的表现与财富 500 强公司的表现进行比较,更说明了它的非凡之处:如果它是一家独立的公司,它完全有资格进入这个名单。

以最新的 1993 年财富 500 强名单来说,该公司的股东权益回报率排第四,故事还没完,前三名分别是Insilco、LTV 与 Gaylord,全部都是因为当年在破产程序中获得的债务免除而致使收益暴增,扣除这些并没有什么实质性的盈利。因此撇开这些非经营性意外之财,ScottFetzer 的股东权益回报率足以名列 500 强首位,且远远领先第二名,甚至是第十名的两倍之多。

或许你会认为该公司的成功只能用收益周期的高峰、垄断地位或是财务杠杆来解释,不过全都不对,这家公司真正成功的原因在于 CEO 拉尔夫·谢伊(Ralph Schey)优异的管理技能,这点在后面我们还会详加报告。

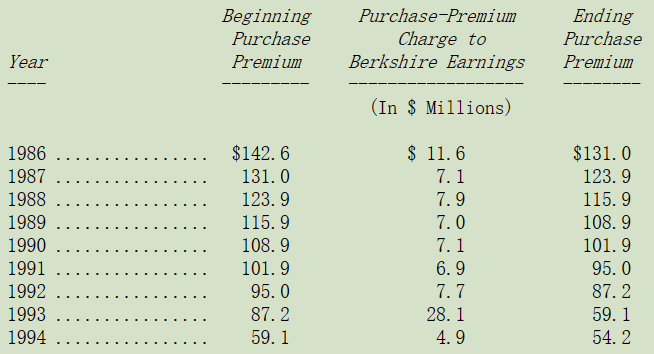

接下来是之前说过的会计课,我们支付超过 ScottFetzer 帐面价值 1.426 亿美元的溢价,将会被记录在伯克希尔的资产负债表上,详细的细节我就予以省略,这些溢价在入账之后,不管怎样都必须当作成本按年摊销,并计入每年的收益报表之上。

下表显示,第一栏是伯克希尔每年必须慢慢地摊销购买 ScottFetzer 所产生的溢价的余额,第二栏是每年必须摊销的金额,这些费用对现金部位或税负支出都不会有影响,同时就我们的观点而言,也没有任何实质的经济意义(虽然很多会计师可能不同意我们的看法),这不过是让我们的帐列投资成本能够慢慢减少,到最后终与ScottFetzer 帐列的账面价值一致的方法而已。

大家可能注意到截至 1994 年底为止,帐列的溢价还剩下 5420 万美元(已摊销 8840 万),这个数字若再加上ScottFetzer 当年底的账面价值 9400 万美元的话,就等于伯克希尔帐上持有该公司的投资成本 1.482 亿美元,这个数字甚至不到当初我们买下它时的一半,然而 ScottFetzer 现在每年所赚的钱,却是当时的二倍,很明显的,其内在价值一直都在成长,然而通过溢价摊销,伯克希尔帐上持有的投资成本却一再向下调整。

ScottFetzer 内在价值与其在伯克希尔帐上的帐面价值的差异是巨大的,如同先前我曾经提到的,而现在也很高兴再重申一次,这种不对称的现象完全都要归功于 Ralph Schey,他是位专注、聪明且高格调的经理人。

Ralph 之所以能够成功的原因并不复杂,我的老师格雷厄姆 45 年前就告诉我:在投资中,没有必要做非凡的事情来获得非凡的结果。而后在我的投资生涯中,我惊讶地发现,这道理也适用在企业管理之上,经理人真正应该做的是做好基本工作而不分心。这正是 Ralph 的做事方法,在设立好正确的目标后,并毫不犹豫放手去做,至于在私底下,Ralph 也是很好共事的人,他对问题直言不讳,自信而不自大。

他经验丰富。虽然我不知道 Ralph 今年真正的岁数,但我确信他跟我们旗下其它许多经理人一样老早就过了65 岁,在伯克希尔我们注重的是绩效,而不是年资。查理今年 71 岁,而我 64 岁,我们都把拳王 GeorgeForeman 的照片摆在桌上,你可以记下,我们对于强制退休年龄的反感程度将会逐年增加。

〔译文源于芒格书院整理的巴菲特致股东的信〕