巴菲特致股东的信(1994年)

⑤报告收益来源

报告收益来源

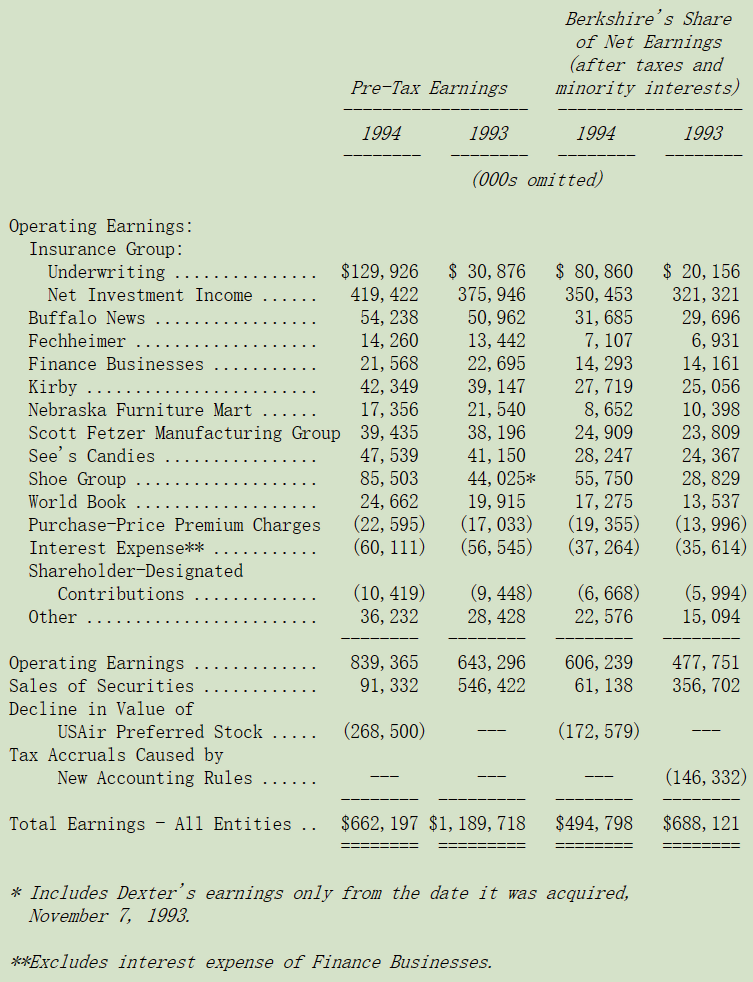

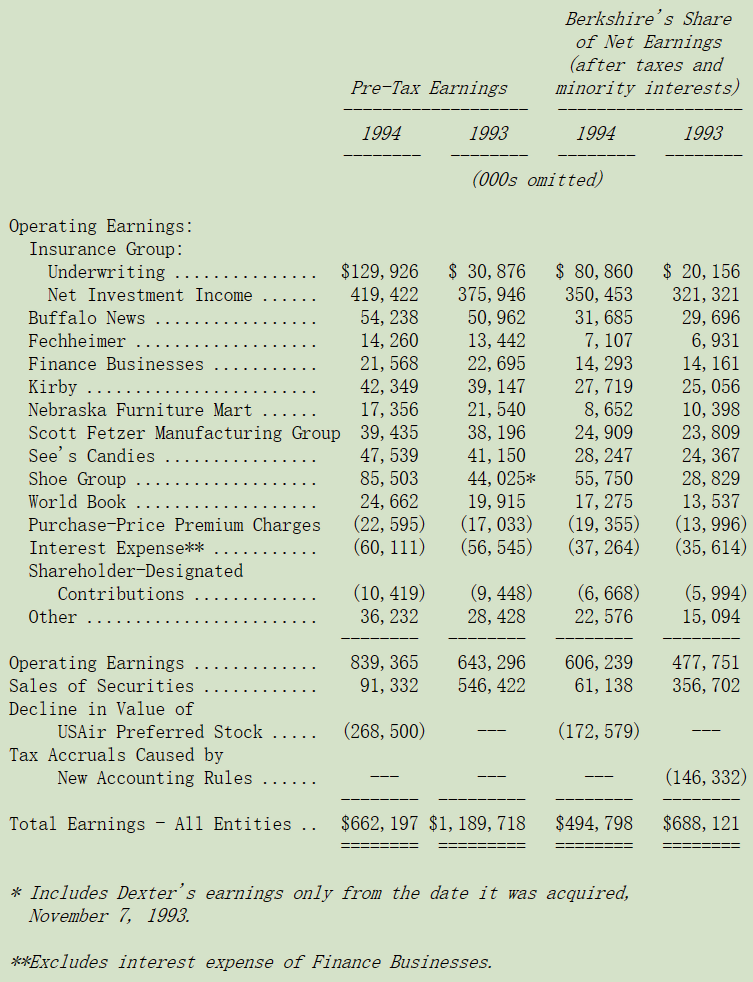

下表显示伯克希尔报告收益的主要来源。就像我们在前面对 ScottFetzer 的分析中所讨论的类型一样,下表中被投资公司的购买溢价单独分离出来汇总列示,之所以这样做是为了让旗下各事业的收益状况,不因我们的投资而有所影响。在我们看来,这样的表述方式对投资者或经理人来说比 GAAP 的方式更有帮助,因为 GAAP 要求按业务逐笔摊销购买溢价。当然最后损益加总的数字仍然会与 GAAP 的数字一致。

在年报中你可以找到依照 GAAP 原则编制的详细的部门信息,以及按照查理跟我的方式重新划分业务的财务信息。我们报告的目标是,假如我们角色互换,向你的提供的财务信息,跟你提供给我们的完全一致。

〔译文源于芒格书院整理的巴菲特致股东的信〕