巴菲特致股东的信(1994年)

⑥透视收益

透视收益

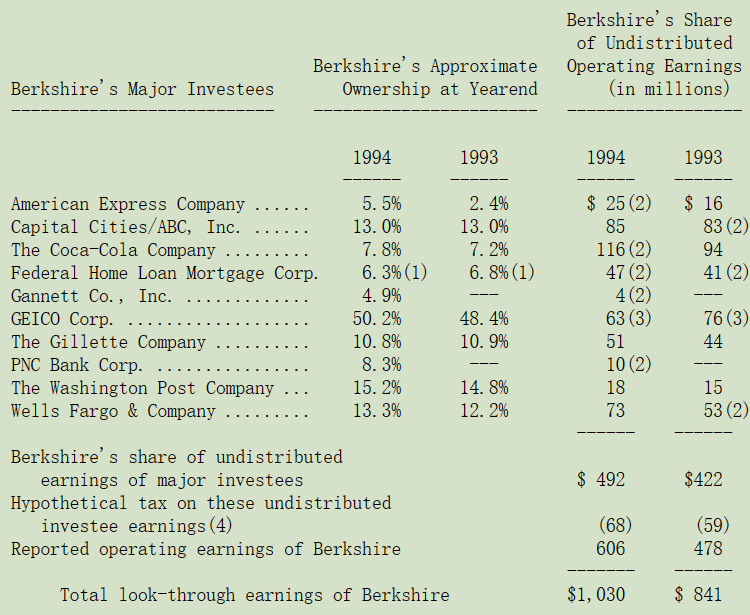

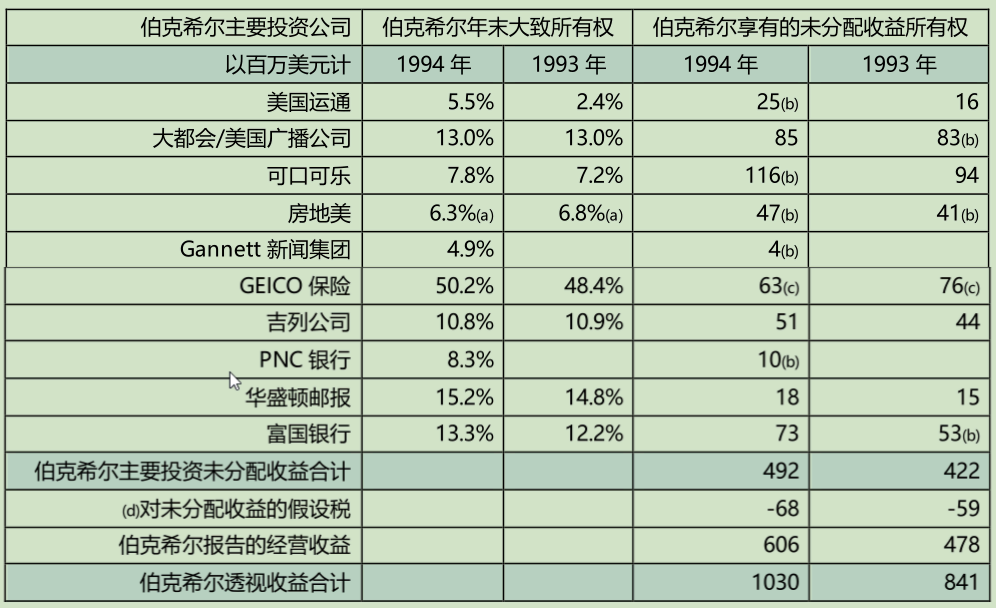

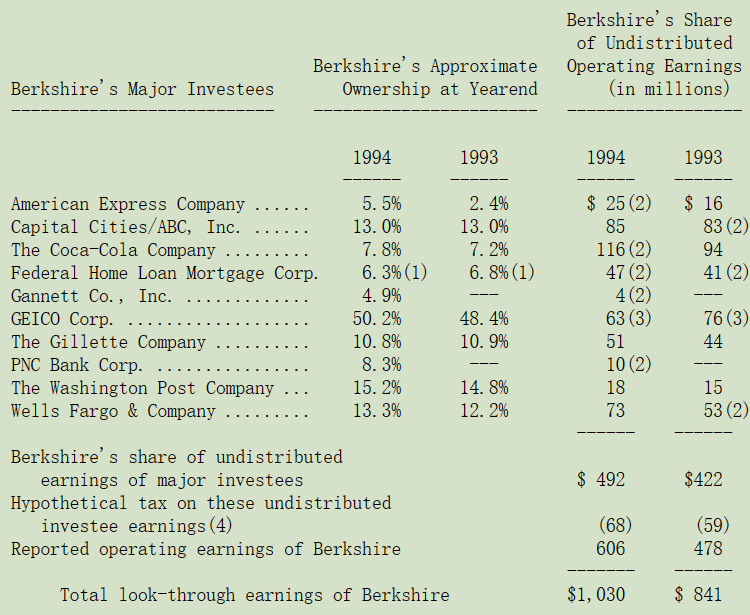

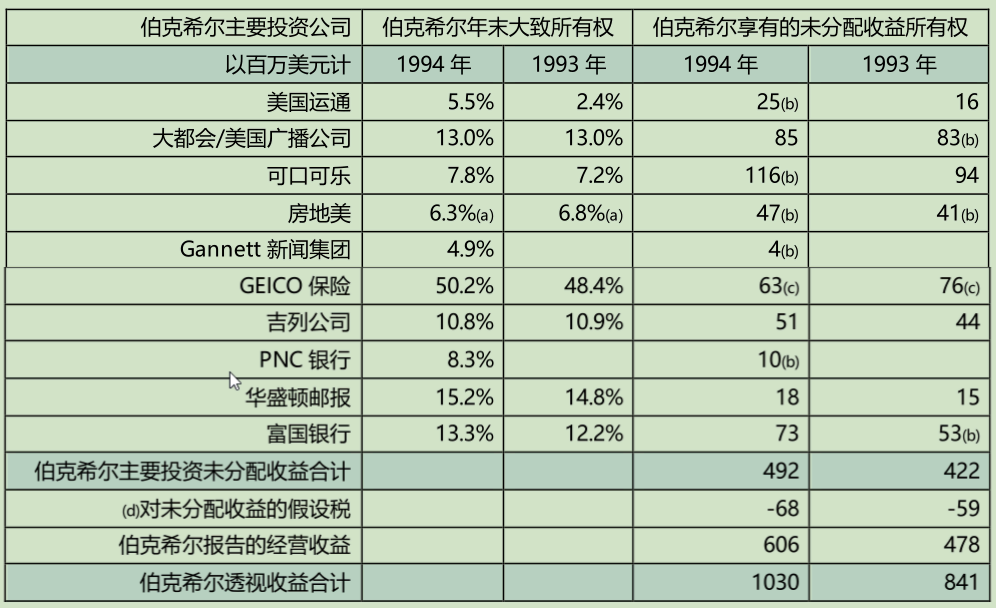

过去的报告中我们曾经讨论过透视收益,我们认为它比 GAAP 的数字更能反应伯克希尔真实的盈利状况,其主要的组成份子有(1)前段报告中的报告收益,加上(2)按 GAAP 会计原则未反映在我们利润中的主要被投资公司的保留收益,减去(3)若这些未反映的收益分配给我们时,将要支付的所得税估计值。在这里我们所谓的经营收益系扣除资本利得、特别会计调整与企业重组等支出。

长期而言,如果我们的内在价值想要以每年 15%的幅度来成长的话,那么透视收益每年也必须以这个幅度来成长。几年前我第一次提到这个概念时曾表示,若要实现 15%的目标,我们需要在 2000 年之前完成 18 亿美元以上的透视收益成长。而由于 1993 年我们又发行了约 3%新股购买 Dexter,所以现在的门槛提高到 18.5 亿美元。

我们现在稍微超越目标进度,这在很大程度上是因为我们的巨灾再保险近年来的表现远超预期(下一节再详加叙述),扣除这项反常部分,我们依旧符合当初预期,但这仍不能保证一定实现目标。

下表显示了我们是如何计算透视收益的,不过我还是要提醒各位这些数字有点粗糙,被投资公司所分配的股利收入包含在保险业务的净投资收益项下。

(a)已扣除 wesco 的少数股权;

(b)以年平均持有股权比例计算;

(c)扣除重复发生且金额大的已实现资本利得;

(d)通用的税率为 14%,这里是伯克希尔收到现金股利时的平均税率。

〔译文源于芒格书院整理的巴菲特致股东的信〕